The TSP is better if your taxes are high today and you expect them to be much lower in retirement. It’s best to use your deduction against the higher tax rate. The Roth IRA is better the further you are from retirement.

How many TSP millionaires are there in 2021?

As of December 31, 2021, there were 112,880 TSP millionaires, so the drop in Q1 2022 represents an 11% drop from Q4 2021.

How many millionaires in the TSP? In the last quarter of 2021, the number of millionaires investing in the Thrift Savings Plan (TSP) increased dramatically by almost 50%. As of Dec. 31, there were 112,880 TSP millionaires, up from 75,420 a year ago, according to the Federal Retirement Thrift Investment Board.

What is the average amount in TSP balance at retirement?

| Age | Average contribution rate | The equilibrium average |

|---|---|---|

| 60-69 | 11% | $182,100 |

| 70-79 | 12% | $171,400 |

| All ages | 9% | $95,600 |

What is the average TSP account balance?

It’s no surprise that more than half of total plan participants – 3,663,973 – have account balances below $50,000, yet they’ve only been contributing for 5.77 years on average. And about a quarter of participants (1,529,078) are between $50,000 and $249,000, but have been contributing for 15 years on average.

Should I keep my money in TSP after retirement?

Leave it in the TSP and let it grow Depending on when you start to retire, you can simply leave the money in the TSP to continue to grow. If you don’t need to access it yet, it might be a good idea to let it. As with other retirement accounts, you must begin minimum withdrawals at age 72.

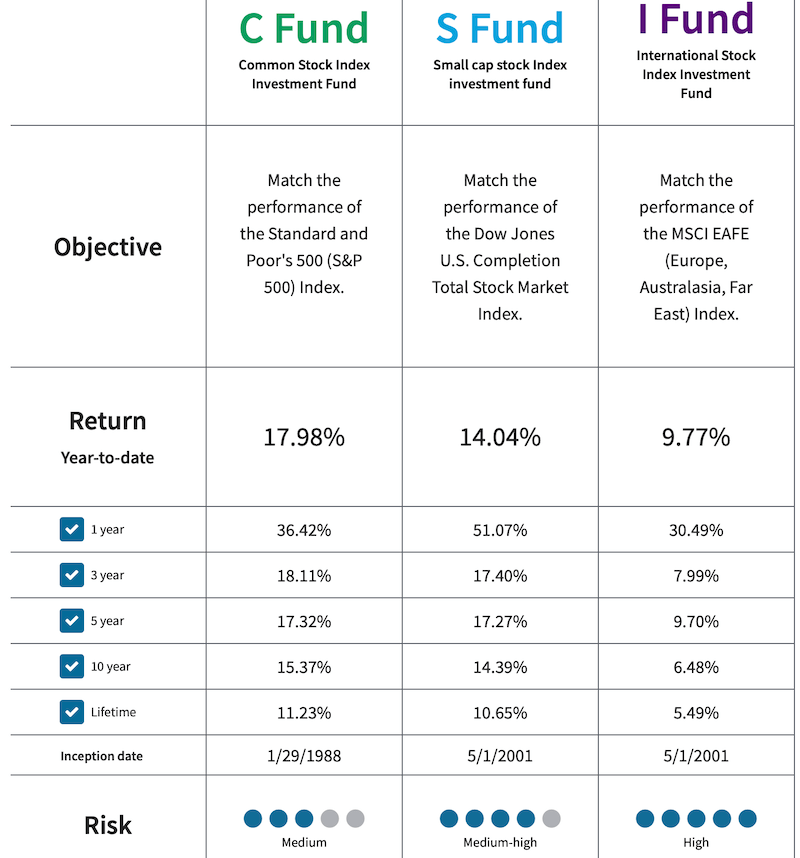

How is the TSP C fund doing?

TSP Fund C rebounded in March with a return of 3.72% after losing 2.99% in February. Fund C is still down 4.59% year-to-date, but is up 15.63% over the past 12 months. Fund G, sometimes considered the safest TSP fund, is up 1.56% over the past 12 months and 0.44% since the start of the year.

How are the TSP funds doing?

So far this year, the S fund is 18.83% in the red. And Fund C’s common shares fell 8.72% last month, taking its 2022 losses to 12.91%. Fund I, made up of international investments, lost 6.39% in April, bringing its performance this year down to -12.73%.

Is the TSP C fund a good investment?

Fund C can be useful in a portfolio that also contains equity funds that track other indices such as Fund S and Fund I. By investing in all segments of the stock market (instead of just one) , you reduce your exposure to market risk. Fund C can also be useful in a portfolio that contains bonds.

Is a million dollars enough to retire at 60?

Yes, you can retire at 60 with $1.5 million. At age 60, an annuity will provide a guaranteed level income of $78,750 annually from now on for the rest of the insured’s life. The income will remain the same and will never decrease.

What is the average amount of money a person has when they retire? A study by the Federal Reserve found that the median retirement account balance in the United States – considering only those with retirement accounts – was just $65,000 in 2019 (the survey is conducted every three years).

How much money do you need to comfortably retire at 60?

Retirement experts have offered various rules of thumb on how much you should save: about $1 million, 80% to 90% of your annual pre-retirement income, 12 times your pre-retirement salary.

How much money do you need to retire comfortably at age 60?

Most experts say your retirement income should be about 80% of your final annual pre-retirement income. 1 This means that if you earn $100,000 a year in retirement, you need at least $80,000 a year to lead a comfortable life after leaving the workforce.

Can I retire at 60 with 800k?

Can I retire at 60 with $800,000? Yes, you can retire at 60 with eight hundred thousand dollars. At age 60, an annuity will provide a guaranteed level income of $42,000 per year from now on for the rest of the insured’s life. The income will remain the same and will never decrease.

Can a 60 year old couple retire on 2 million dollars?

Yes, for some people $2 million should be more than enough to retire. For others, $2 million might not even scratch the surface. The answer depends on your personal situation and you will face many challenges.

Can you live off interest of 2 million dollars?

And can you live off the returns of a $2 million account? The answer is yes, if you’re smart about it.

How much retirement income will 2 million generate?

Retire comfortably with $2 million Here’s how much a $2 million portfolio can generate at various withdrawal rates: At a 2% withdrawal rate, that’s an income of $40,000 a year. At a 3% withdrawal rate, this represents an annual income of $60,000. And at a 4% withdrawal rate, that’s an annual income of $80,000.

How long will a million dollars last in retirement?

Becoming a millionaire seems like a surefire way to live comfortably. However, if you are no longer working, how long will a million dollars last in retirement? The answer is about 20 years, according to Brent Lipschultz, a partner at accounting and consulting firm EisnerAmper in New York.

How long can I make a million dollars last in retirement?

The site says that on average, looking at data from the Bureau of Labor Statistics and average monthly Social Security benefits, having $1 million for retirement could last up to 29 years, 1 month, and 24 days on paper. . It’s definitely a good time if you’re retiring at 60.

Is $1 million enough for a comfortable retirement?

While that may not allow for the lavish lifestyle of years past, having $1 million for retirement is still a blessing. Many retirees rely on Social Security benefits for at least 50% of their income.

How much money do you need to retire with $100000 a year income?

Percentage of your salary Some experts recommend that you save at least 70-80% of your pre-retirement income. This means that if you earned $100,000 the year before you retired, you should plan to spend $70,000 to $80,000 per year in retirement.

What is a good monthly retirement income? According to AARP, a good retirement income is about 80% of your pre-tax income before you left the workforce. Indeed, when you are no longer working, you will not pay income tax or other employment-related expenses.

How much do I need to retire if I make 100k a year?

Most experts say your retirement income should be about 80% of your final annual pre-retirement income. 1 This means that if you earn $100,000 a year in retirement, you need at least $80,000 a year to lead a comfortable life after leaving the workforce.

Is 500k enough to retire at 65?

The short answer is yes – $500,000 is enough for some retirees. The question is how it will work. With a source of income like Social Security, relatively low expenses, and a bit of luck, it’s doable.

How much money do you need to retire with $120000 a year income?

Let’s say you think of yourself as the typical retiree. Between you and your spouse, you currently have an annual income of $120,000. Using the 80% principle, you can expect to need about $96,000 in annual income after you retire, or $8,000 per month.

How much money do you need to retire with $80000 a year income?

Expenditure Based For example, if you and your spouse decide to supplement your Social Security income with an additional $40,000 from your savings each year, you will need a portfolio value of $1 million when you retire. If you and your spouse want to withdraw $80,000 per year, you will need $2 million.

How much do I need to retire with 100k per year?

How much money do you need for $100,000 per year? To create $100,000 in retirement income, you may need $1.9 million in savings.

How much should I have saved for retirement by age 45 if I make $80000 a year?

At age, say, 45 with an annual income of $80,000, your target multiple increases to 3.2 times your income. So if you multiply $80,000 by 3.2, or by 320%, your retirement savings should total $256,000 at that point. Some financial companies recommend aiming for specific multiples of your income at different ages.

How much money do you need to retire with $120000 a year income?

Let’s say you think of yourself as the typical retiree. Between you and your spouse, you currently have an annual income of $120,000. Using the 80% principle, you can expect to need about $96,000 in annual income after you retire, or $8,000 per month.

Can you retire comfortably on 100k a year?

Some experts recommend that you save at least 70-80% of your pre-retirement income. This means that if you earned $100,000 the year before you retired, you should plan to spend $70,000 to $80,000 per year in retirement.

How much money do you need to retire with $150 000 a year income?

The final multiple: 10 to 12 times your annual income at retirement age. If you plan to retire at age 67, for example, and your income is $150,000 a year, you should have between $1.5 and $1.8 million set aside for retirement.

How much will my TSP grow after retirement?

When the Federal Employees Retirement System was introduced, experts said the TSP would be essential because, along with Social Security and a modified civil service pension, the TSP could provide up to 30% to 50% of the retiree’s total income.

How much money should I have in my TSP when I retire? Most experts say your retirement income should be about 80% of your final annual pre-retirement income. 1 This means that if you earn $100,000 a year in retirement, you need at least $80,000 a year to lead a comfortable life after leaving the workforce.

How much should I have in my TSP at 50?

At 40, you should have three times your annual salary. At age 50, six times your salary; at age 60, eight times; and at age 67, 10 times. 8 If you turn 67 and earn $75,000 a year, you should have saved $750,000.

How much should I have in my TSP at age 50?

Retirement savings goals At age 40, you should be earning three times your annual salary. At age 50, six times your salary; at age 60, eight times; and at age 67, 10 times. 8 If you turn 67 and earn $75,000 a year, you should have saved $750,000.

How much should I have saved for retirement by age 55?

Depending on these parameters, you may need 10 to 12 times your current annual salary saved when you retire. Experts say you have at least seven times your salary saved by age 55. This means that if you earn $55,000 a year, you should have at least $385,000 saved for retirement.

Does TSP still grow after retirement?

Depending on when you start to retire, you can just leave the money in the TSP and let it continue to grow. If you don’t need to access it yet, it might be a good idea to let it. As with other retirement accounts, you must begin minimum withdrawals at age 72.

What happens to my TSP after I retire?

If your vested account balance is $200 or more when you leave federal service, your TSP account remains where it is until you need it. You can keep more of what you save with our low costs. Plus, you can change your investment mix and transfer eligible funds into your account.

How much should I have in my TSP at 50?

How much should I have in my TSP at age 50? By age 30, you should have saved half of your annual salary. At 40, you should have double your salary, and at 50, you should be withdrawing about four times your salary from your retirement savings.

How much does the average person have in TSP?

As of Dec. 31, it was down to 21,432. The average Thrift Savings Plan balance for participants in the federal employee retirement system — 3.3 million people — was $138,933 in January. This compares to an average TSP account balance of $146,642 for the 314,193 participants in the public service pension system.

How much does the average federal employee have in TSP?

In April, the average TSP account balance for investors under the Federal Employees Retirement System was $145,423. That was up from $142,512 in March of this year. Just over 3.4 million workers and retirees under the FERS system have TSP accounts.

What is a good TSP balance at retirement?

At the 4% withdrawal rate recommended by many of these same financial planners, a balance of $500,000 will allow us to safely withdraw inflation-indexed $20,000 per year for the rest of our lives; $1,000,000 would bring that to $40,000.

Will I be a TSP Millionaire?

If you take the Long-Term Investing course, you can, as 112,000 federal and postal entry-level workers did, become a TSP millionaire. Maybe with $2-3 million which, along with your regular federal pension and inflation-indexed Social Security, will guarantee you a better retirement. As in much better.

How much does the average person have in TSP?

How many TSP participants are millionaires?

FedSmith notes that based on the latest data provided by the Federal Retirement Thrift Investment Board (FRTIB), 1.7% of all Thrift Savings Plan investors – numbering around 6.3 million – are now millionaires. They have been participating in the TSP for an average of 28.2 years.

How many federal employees are TSP millionaires?

Bad news: too many people know it! The number of federal/postal employees who have become Thrift Savings Plan millionaires has skyrocketed in recent years.

How long does it take to be a TSP Millionaire?

It is an “elite club”. With over 75,000 members, TSP millionaires have earned their title by contributing to the TSP for 25-30 years, being at least moderately aggressive in investing their funds. New members are welcome, but once you’ve reached the financial “peak”, you have to work just as hard to stay there.

Can you be a millionaire from TSP?

As of Jan. 31, there were 112,880 TSP millionaires, up from 75,420 a year ago, according to the Federal Retirement Thrift Investment Board. What sets these TSP millionaires apart? Nothing.

How many federal employees are TSP millionaires?

Bad news: too many people know it! The number of federal/postal employees who have become Thrift Savings Plan millionaires has skyrocketed in recent years.

Sources :