What is the average nest egg in retirement?

Key to take away. U.S. workers had an average of $ 95,600 in their 401 (k) plans at the end of 2018, according to one large study.

What is considered a good retirement egg? Retirement Savings The Fidelity Savings Guidelines say a 40-year-old should have a nest twice his annual income; by age 50, the egg should be four times the income, and at age 60, retirement savings should be six times the current income.

How much does the average 65 year old have in retirement savings?

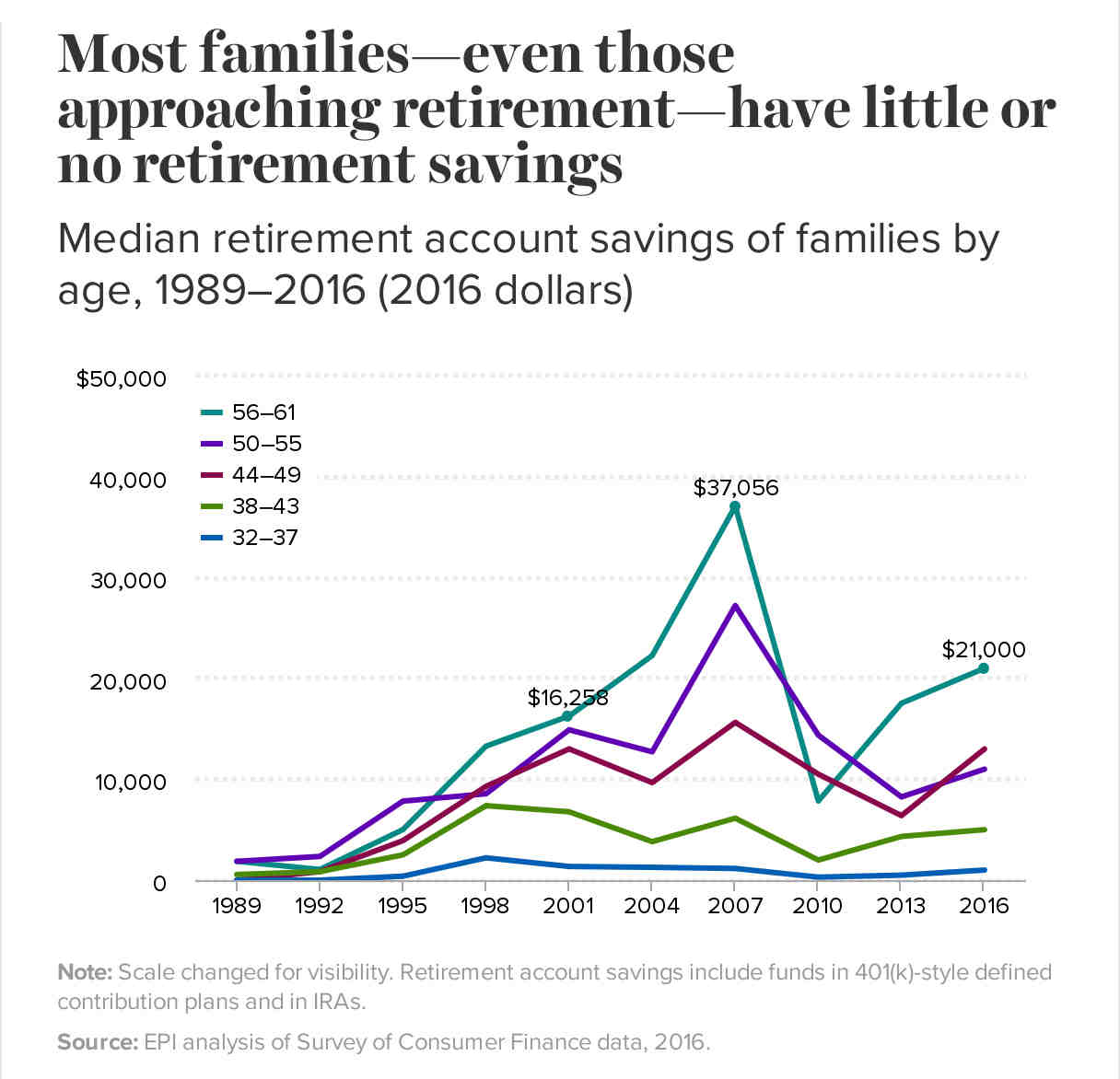

Those who have pension funds do not have enough money in them: according to our research, people aged 56 to 61 have an average of $ 163,577, and those aged 65 to 74 have even less savings. 11 If that money turned into a life annuity, it would be only a few hundred dollars a month.

How much does the average married couple have saved for retirement?

The average retirement income for married couples over the age of 65 was $ 101,500 in 2020. Since high incomes tend to raise the average, median retirement income could be a better measure.

How much should a married couple have saved for retirement by age 50?

Retirement Savings Goals By the age of 40, you should have triple the annual salary. Up to 50 years, six times your salary; up to 60 years eight times; and by the age of 67 10 times. 8 If you turn 67 and earn $ 75,000 a year, you should have $ 750,000 saved.

How much savings does the average person have when they retire?

The survey, overall, found that Americans increased their personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. Moreover, average retirement savings increased by a reasonable 13%, from $ 87,500 to $ 98,800.

How much does the average retiree have in savings?

A Federal Reserve study found that the median balance on a U.S. retirement account – looking at only those with retirement accounts – was only $ 65,000 in 2019 (the survey is conducted every three years).

What is a good 401k balance at age 60?

By age 40, you should have triple the annual salary. Up to 50 years, six times your salary; up to 60 years eight times; and by the age of 67 10 times. 8 If you turn 67 and earn $ 75,000 a year, you should have $ 750,000 saved.

How much does the average 60-year-old save for retirement? Americans in their 30s: $ 45,000. Americans in their 40s: $ 63,000. Americans in their 50s: $ 117,000. Americans in their 60s: $ 172,000.

What is the average 401K balance for a 60 year old?

| DOB | AVERAGE STATE 401K | MEDIAN 401 K BALANCE |

|---|---|---|

| 45-54. | $ 161,079 | $ 56,722 |

| 55-64. | $ 232,379 | $ 84,714 |

| 65 | $ 255,151 | $ 82,297 |

How much does the average 65 year old have in retirement savings?

According to the Federal Reserve, the average amount of retirement savings for people aged 65 to 74 is just north of $ 426,000. While this is an interesting fact, your special retirement savings may be different from someone else’s.

How much should I have in my 401k at age 60?

According to the results, the average 60-year-old should have between $ 800,000 – $ 5,000,000 saved in his 401,000, depending on the company’s relevance and investment performance. Just one or two percentage points in the performance difference can really add a lot in a 30-year savings period.

Do you lose your pension if you quit?

If your retirement plan is 401 (k), then you can keep everything in your account, even if you resign or are fired. The money in that account is based on your contributions, so it is considered yours.

Is it possible to lose a pension? Key to take away. Retirement plans can become underfunded due to poor governance, poor return on investment, employer bankruptcy and other factors. Religious organizations may waive pension insurance, giving their employees a smaller safety net.

What happens to my pension if I quit my job?

Retirement options when you leave work Usually, when you leave a job with a defined benefit pension, you have several options. You can choose to take the money as a lump sum now or accept the promise of regular payments in the future, also known as an annuity. You may even be able to get a combination of both.

Can I cash out my pension if I lose my job?

You can cash in on your retirement plan if you are fired, but you may also have to pay a penalty for early distribution unless your plan has an early payment clause or you do not transfer your retirement funds to another plan such as the IRA.

What happens to pension when you quit?

Retirement options when you leave work Usually, when you leave a job with a defined benefit pension, you have several options. You can choose to take the money as a lump sum now or accept the promise of regular payments in the future, also known as an annuity. You may even be able to get a combination of both.

What happens to retirement when you leave the UK? Your retirement still belongs to you. If you do not continue to pay into the program, the money will remain invested and you will receive a pension when you reach retirement age under the program. You can join another workplace pension system if you get a new job.

What happens to my pension if I leave before retirement?

Whether you will receive a pension from your former employer when you retire depends on how long you have been doing that job. The less time you spend with that employer, the lower your payout. Moreover, your right to “keep” your traditional pension is determined by your employer’s entitlement schedule.

Can I withdraw my pension before retirement?

Payment of pensions: restrictions, rules and early retirement. If you are 55 or older and have a defined contribution pension, you can usually start raising your pension. Sometimes you can do this before age 55, but you may have to wait until age 65 if you have a defined benefit plan.

What happens to my pension if I leave?

When you leave your employer, you do not lose the pension you earned in retirement and the pension fund belongs to you. As with all pensions, there are several options available to you when you leave work.

What percentage of retirement have a million dollars?

But how many people have $ 1,000,000 in retirement savings? Well, according to a United Income report, one in six retirees has a million dollars.

How much money do most retirees have? According to this study by the Transamerica Center for Retirement Studies, the average retirement savings by age in the United States is:

- Americans in their 20s: $ 16,000.

- Americans in their 30s: $ 45,000.

- Americans in their 40s: $ 63,000.

- Americans in their 50s: $ 117,000.

- Americans in their 60s: $ 172,000.

How much does the average person have in savings when they retire?

The survey, overall, found that Americans increased their personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. Moreover, average retirement savings increased by a reasonable 13%, from $ 87,500 to $ 98,800.

How much does the average 65 year old have in retirement savings?

Those who have pension funds do not have enough money in them: according to our research, people aged 56 to 61 have an average of $ 163,577, and those aged 65 to 74 have even less savings. 11 If that money turned into a life annuity, it would be only a few hundred dollars a month.

What is the average retirement savings in 2020?

According to Fidelity, in the first quarter of 2020, the average balance of the defined contribution plan was $ 126,083, and the average balance of the IRA was $ 135,700. U.S. savings expectations for a comfortable retirement rose to $ 1.04 million in 2021, an increase of 10 percent from 2020.

How much does a million dollars last in retirement?

The site says that on average, looking at data from the Bureau of Labor Statistics and average monthly social security benefits, a million dollars for retirement can take as much as 29 years, 1 month and 24 days on paper. That’s certainly a good amount of time if you retire at 60 years old.

Is a million dollars a good retirement amount?

While it doesn’t provide for the lavish lifestyle of years past, having a million dollars for retirement is still a blessing. Many retirees rely on social security for at least 50% of their income.

Can you live off of 1 million dollars for the rest of your life?

Is a million dollars enough money to secure a financially secure pension today? A recent study found that a $ 1 million egg for retirement will last an average of about 19 years. Based on that, if you retire at age 65 and live to age 84, a million dollars will be enough for your retirement savings.

Sources :