How much money does the average American have at retirement?

A study by the Federal Reserve found that the average pension account in the United States – which only applies to pensioners – was only $ 65,000 in 2019 (an annual survey three others). The estimated standard was $ 255,200.

How much does a 65-year-old generally have in retirement savings? Those with retirement benefits do not have enough money for them: According to our research, children aged 56 to 61 have an average of $ 163,577, and are 65 to 65 years old. 74 have less money. 11 If that amount were changed for a year, it would be only a few hundred dollars a month.

How much wealth does the average American retire with?

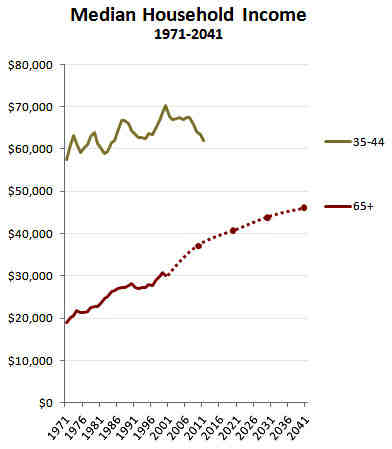

The average household income in the United States is $ 121,700, but almost doubled in the 50’s and early 60’s. According to a recent Fed Consumer Finance Survey since 2019, the total value of Americans between the ages of 55 and 64 is $ 212,500.

How much net worth does the average American retire with?

In a similar Federal Reserve report, the average household income for a 35-44-year-old family head is $ 91,300. For a 45- to 54-year-old family head, that amount is $ 168,600. At the age of 55-64, the total amount is $ 212,500.

How much does the average American have saved for retirement?

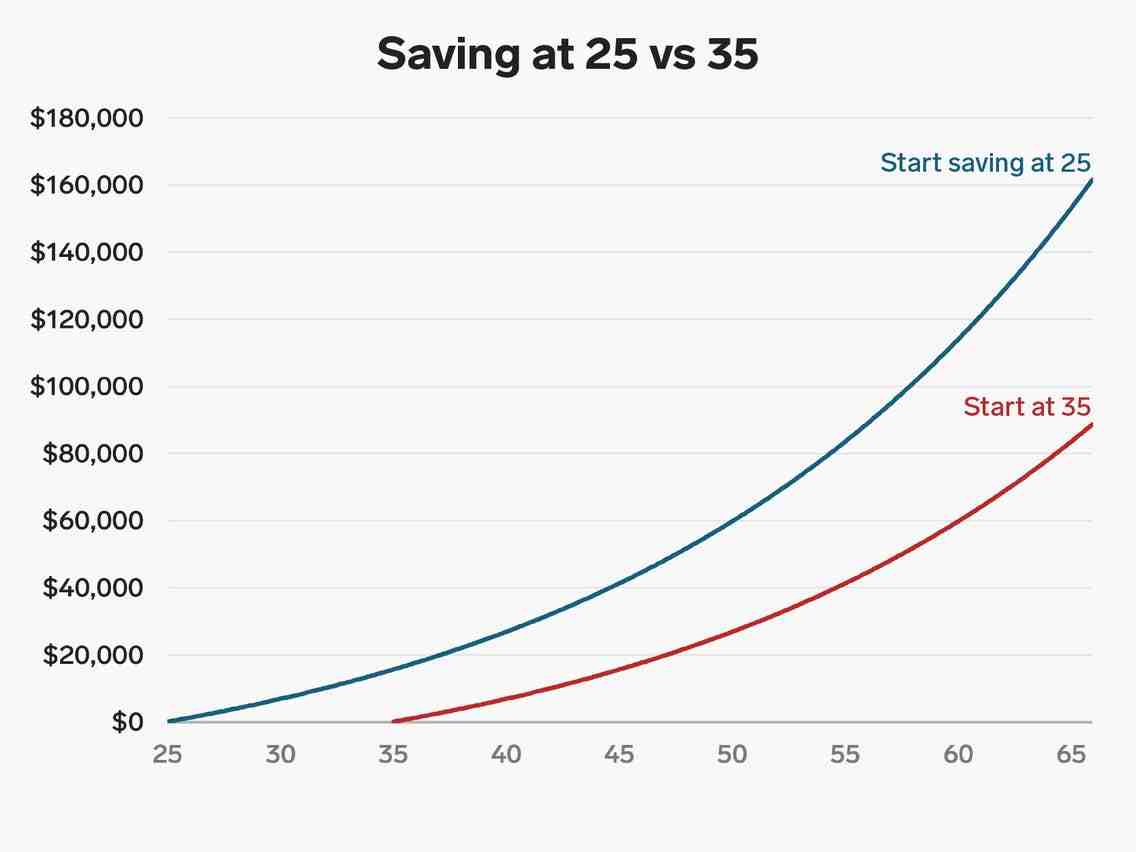

Although the recommended retirement savings amount is up to four times your annual salary, this is not true for most Americans. The average income for those in their 40s is over $ 50,000, but the retirement savings rate for this age group is $ 63,000.

Can I retire on 80000 a year?

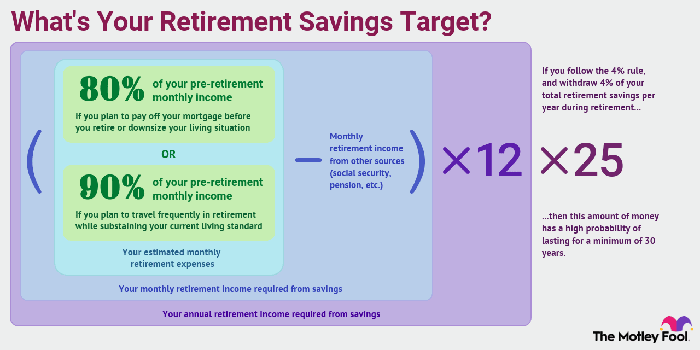

Percentage of Your Income Some experts recommend that you save at least 70 – 80% of your salary before you retire. This means that if you earn $ 100,000 a year before you retire, you should plan to spend $ 70,000 – $ 80,000 a year when you retire.

What is the average retirement income? A study by the Federal Reserve found that the average retirement account income in the United States – looking only at retirement accounts – was only $ 65,000 in 2019 (a survey conducted over a period of years. every three). The estimated standard was $ 255,200.

How much money do you need to retire with $80000 a year income?

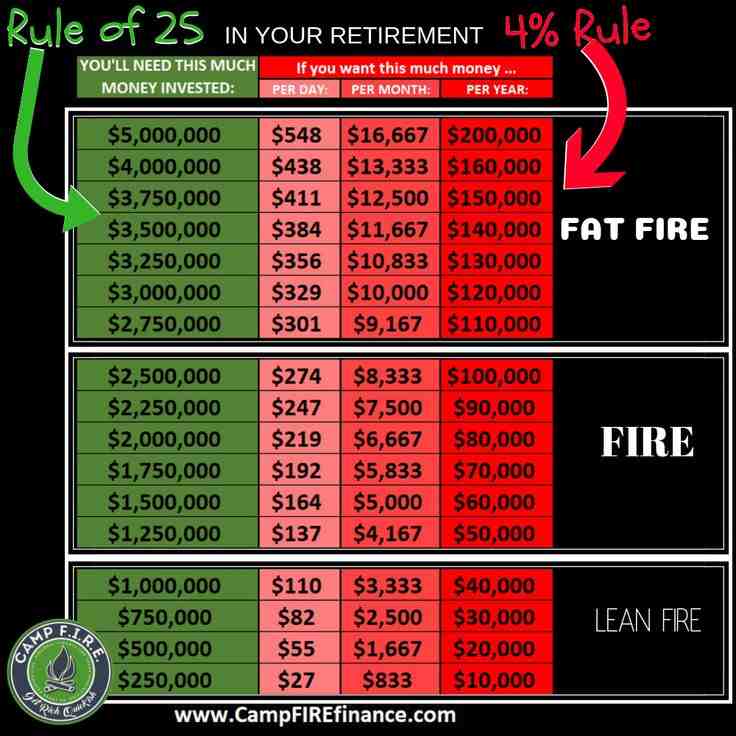

Depending on the Cost For example, if you and your spouse decide to increase your Social Security cover by an additional $ 40,000 from your savings each year, you will need a $ portfolio value 1 million when you retire. If you and your spouse want to spend $ 80,000 a year, you will need $ 2 million.

How much do I need to retire on $75000 a year?

According to the Retirement Research Center at Boston College, you will need at least 80 percent of your retirement income. This is sometimes called â € œreplacement income.â € So if you earn $ 75,000 a year now, you will need at least $ 60,000 a year to maintain your lifestyle.

How much should I have saved for retirement by age 45 if I make $80000 a year?

For years, say, 45 with an annual income of $ 80,000, your goal goes up to 3.2 times your salary. So if you multiply $ 80,000 by 3.2, or 320%, your retirement income should be $ 256,000 then. Some financial companies recommend that you be willing to earn a living for your various years.

What is a good monthly income for retirees?

According to AARP, a decent retirement benefit is about 80 percent of pre-tax pay before retirement. This is because once you are unemployed, you will not be paying your income tax or other work-related expenses.

How much does the average retired couple spend per month?

According to the Bureau of Labor Statistics, an American family led by a person aged 65 and over spent an average of $ 48,791 a year, or $ 4,065.95 a month between 2016 and 2020.

What is a good retirement amount for a couple?

Many experts estimate that retirement benefits should be as high as 80 percent of the couple’s annual income before retirement. Fidelity Investments recommends you save 10 times your annual income for 67 years.

Is $80000 a year enough to retire on?

Financial planners usually recommend a return on 80% of your income before you retire to maintain a standard of living after retirement. That means that if you earn $ 100,000 a year, you will be able to earn about $ 80,000 (in modern dollars) when you retire.

How much does the average retired person live on per year?

| In the middle | Say | |

|---|---|---|

| Total annual retirement benefits for those over the age of 65: | $ 47,357 | $ 73,288 |

| Average annual retirement benefits for 65- to 74-year-olds: | $ 56,632 | $ 84,153 |

| Average annual retirement benefits for 75-year-olds: | $ 37,335 | $ 58,684 |

What is the average amount of money a person has when they retire?

A study by the Federal Reserve found that the average retirement account income in the United States – looking only at retirement accounts – was only $ 65,000 in 2019 (a survey conducted over a period of years. every three).

How much does the average American need to retire?

Financial planners usually recommend a return on 80% of your income before you retire to maintain a standard of living after retirement. That means that if you earn $ 100,000 a year, you will be able to earn about $ 80,000 (in modern dollars) when you retire.

How much does the average American retire? The survey, in general, found that Americans increased their personal income by 10% from $ 65,900 by 2020 to $ 73,100 by 2021. In addition, the number of retirement benefits increased by 13% reasonable, from $ 87,500 to $ 98,800.

How much does the average person have in retirement when they retire?

Although the recommended retirement savings amount is up to four times your annual salary, this is not true for most Americans. The average income for those in their 40s is over $ 50,000, but the retirement savings rate for this age group is $ 63,000.

How much does average person have in 401K when they retire?

| YEARS | TOTAL 401K EQUALITY | MEDIAN SERVICE 401K |

|---|---|---|

| 25-34 | $ 33,272 | $ 13,265 |

| 35-44 | $ 86,582 | $ 32,664 |

| 45-54 | $ 161,079 | $ 56,722 |

| 55-64 | $ 232,379 | $ 84,714 |

What is the average Social Security income?

| Type of heir | They are heirs | Average monthly benefits (dollars) |

|---|---|---|

| Number (thousands) | ||

| Overall | 65,544 | 1,538.14 |

| Aging and Survivor Insurance | 56,376 | 1,588.89 |

| Retirement benefits | 50,474 | 1,619.67 |

How much money can you get from Social Security? The number of applicants for Social Security retirement benefits in 2022 can be received per month: $ 2,364 for file applicant 62. $ 3,345 for retirement applicant (months 66 and 2 for persons born in 1955, 66). and 4 months for people born in 1956).

What is the average Social Security at 62?

According to payment figures from the Social Security Administration by June 2020, the average Social Security benefit at age 62 is $ 1,130.16 per month, or $ 13,561.92 per year.

What is the average Social Security benefit at age 62 in 2022?

The amount you are entitled to receive has been changed by other factors, especially the age at which you are seeking benefits. For references, the estimated retirement benefit for Social Security in 2022 is $ 1,657 per month.

How much would I receive if I retire at 62?

A single person born in 1960 who earned $ 50,000, for example, would earn $ 1,349 a month with a retirement of 62 – before he started collecting. The same person would earn $ 1,927 by waiting up to 67 years, a full retirement age.

How much does a 100 000 annuity pay per month?

How much does a $ 100,000 Annuity Annual Pay? $ 100,000 annuity will pay you about $ 438 a month for the rest of your life if you could buy an annuity at the age of 60 and start paying right away.

How much does an annuity pay you? Rates are based on your age, gender and interest rate when you purchase a year. For example, a 65-year-old man who makes $ 100,000 a year instantly earns about $ 494 a month for life ($ 5,928 a year). A 65-year-old woman could earn about $ 469 a month ($ 5,628 a year).

How much does a 120000 annuity pay per month?

If a 72-year-old man invests in $ 120,000 a year that pays off once in his lifetime, he will earn about $ 810 a month.

How much does a 100 000 annuity pay per month Canada?

Life annuity gives you a guaranteed lifetime income. For example, if you buy an annual income of $ 100,000 at the age of 65 with an income of $ 500 per month, you get your $ 100,000 at the age of 82. If you live 82 years, you you will still earn $ 500 a month as long as you live.

How long will a 100000 annuity last?

Using information from our model, the form allows us to calculate monthly payments. Thus, at a rate of 2 percent growth, the $ 100,000 annuity pays $ 505.88 per month for 20 years.

How long will a 100000 annuity last?

Using information from our model, the form allows us to calculate monthly payments. Thus, at a rate of 2 percent growth, the $ 100,000 annuity pays $ 505.88 per month for 20 years.

How much does a 1000 per month annuity cost?

By comparison, the cost of a single year-long one can cost you $ 1,000 a month as long as you live can be $ 185,000.

How much will a 100000 annuity pay per year?

After researching 326 annuity products from 57 insurance companies, our sources calculated that $ 100,000 annuity would pay: If you are 30 years old now and do not invest, you will earn $ 14,220 annually starting at 60 years. This comes from $ 1,185 per month for the rest of your life.

How much is an annuity that pays 1000 a month?

By comparison, the cost of a single year-long one can cost you $ 1,000 a month as long as you live can be $ 185,000. Not only that, but if you live longer than your life expectancy, your annuity lasts at no further cost to you. It takes your whole life.

What is the monthly payout for a $500 000 annuity?

In the case of the $ 500,000 annual guaranteed year with a profit of 2.85 percent, the monthly payments for a period of 10 years would be $ 4,795.

How much does a 750 000 annuity pay per month?

How much does a $ 750,000 annuity pay per month? Our data has revealed that $ 750,000 annuity will pay between $ 3,437.49 and $ 9,549.00 per month for life if you use a lifetime gambler. Rates depend on the age at which you purchase the annual contract and the length of time before you take the money.

Sources :