How do I check my FERS balance?

How can I find out my retirement account balance? If you are a current employee, you should contact your human resources office. If you have separated from federal service or are currently a retiree, you should contact the OPM Office of Retirement at 1-888-767-6738 or retire@opm.gov.

When a husband dies does the wife get his Social Security?

Widowed or widowed, full retirement age or older: 100% of the deceased worker’s benefit amount. Widowed or widowed, age 60—full retirement age—71½ to 99% of deceased worker’s base. Widower or widower with a disability from 50 to 59 years old: 71½%.

How long does it take to pay death benefits in South Africa? The provision requires the fund to make the payment within 12 months of the date of death. Thus, unlike points 1 and 2 above, the trustees must make their decision and make the distribution within the 12-month period.

When the entire death benefit is paid in a lump-sum?

What is the Social Security lump sum death payment? The Social Security Lump Sum Death Payment (LSDP) is federally funded and administered by the U.S. Social Security Administration (SSA). A surviving spouse or child may receive a special lump sum death payment of $255 if you meet certain requirements.

What is a defined benefit lump sum death benefit?

Defined Lump Sum Death Benefit (DBLSDB) This is a lump sum paid out of a defined benefit arrangement. There is no limit on the level of defined benefit lump sum death benefit that can be paid from a defined benefit plan. DBLSDB is generally only paid in the event of death before retirement.

What is a lump sum beneficiary?

Lump Sum Beneficiary means a person, other than a Covered Life Insurance or Contingent Life Insurance, who appears in the Company’s records as the person designated to receive the Lump Sum Death Benefit Amount associated with the Insurance. corresponding Life.]

How do I claim a lump-sum death benefit?

Form SSA-8 | Information you need to apply for the lump sum death benefit. You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local Social Security office.

Who is eligible for lump-sum death payment?

Only the widow, widower, or child of a Social Security beneficiary can collect the $255 death benefit, also known as a lump sum death payment. Priority is given to the surviving spouse if any of the following apply: The widow or widower was living with the decedent at the time of death.

How long does it take to start getting survivor benefits?

Survivor benefit payments take 30 to 60 days to begin after they are approved, according to the agency’s website.

How long does it take to get survivor benefit?

Survivor benefit payments take 30 to 60 days to begin after they are approved, according to the agency’s website.

How long does it take to receive survivor benefits after being approved?

Generally, if your application for Social Security Disability Insurance (SSDI) is approved, you must wait five months before you can receive your first SSDI benefit payment. This means that you would receive your first payment in the sixth full month after the date we found out your disability began.

How long after death can you claim survivor benefits?

You can apply for survivor benefits starting at age 50 if you are disabled and the disability occurred within seven years of your spouse’s death. If you are caring for children under the age of 16 or disabled, you can apply at any age.

What’s the average Social Security check at 62?

According to payment statistics from the Social Security Administration as of June 2020, the average Social Security benefit at age 62 is $1,130.16 per month, or $13,561.92 per year.

Who are the frais of the Société Générale?

Comment obtenir un chèque de banque à la Société Générale ?

Pour Commander a bank check, you can contact your Conseiller at any time via the secure message of your espace client. Upon the issuance of the bank check, your agency verifies that you compte the necessary provision.

Where is the Bank of Africa?

BANK OF AFRICA GROUP is headquartered in Dakar, Senegal, with a strong network of over 500 offices dedicated to operations and service support. Since 2010, the BANK OF AFRICA Group has been majority owned by BMCE Bank, the second largest private bank in Morocco.

Which bank is Bank of Africa?

Since 2010, BANK OF AFRICA Group has been majority owned by BMCE Bank (recently renamed BANK OF AFRICA), the third largest bank in Morocco.

Quelle est la différence entre un chèque de banque et un chèque certifié ?

The seule difference resides in the fact that this is the bank that signs the check, alors that in the case of the check certified that the émetteur who signs the check. Actually, the bank check is encore plus secured by the beneficiary.

Comment obtenir la Green Card grâce aux liens familiaux ?

If your partner, fiancé or parent is currently in the State-Unis, it is possible to obtain a Green Card due to the procedure for Adjustment of Statute. Otherwise, the parent will obtain the American residence by the biais de l’Ambassade ou Consulat Américain that examines the immigrant visas dans leur pays.

Comment devenir résident permanent aux États-Unis ?

It is the simplest way to obtain the Green Card if you are married to an American citizen. Pour limiter les mariages blancs, les autorités délivrent une carte verte temporaire pendant les deux premières années de mariage, puis une carte de résident permanent définitif une fois ce délai passé.

Quel est le délai pour avoir un chèque de banque ?

If you present the necessary provision, a check from the bank can be issued to the owner of the designated beneficiary, and must be returned within 48 hours maximum (weekend-end and holiday hours) upon request.

Comment je peux avoir un chèque de banque ?

To obtain a bank check, it is necessary to surrender auprès de sa banque pour en faire la demande. The bank establishment verifies that the bank account du demandeur is suffisamment approvisionné pour émettre un chèque du amount demandé.

Quel est le délai pour avoir un chèque de banque crédit agricole ?

About : obtaining and encaissement If you are in possession of a bank check to Crédit Agricole, the time will normally be at your disposal within 24 hours after the registration of your deposit action. The encaissement of the bank check for the Crédit Agricole will take place on the days that follow.

Can you cash out your FERS retirement?

FERS Withdrawal You can request to have your retirement contributions returned to you in a lump sum payment, or you can wait until you are of retirement age to request monthly retirement benefit payments.

What happens to my FERS if I quit? Since FERS employees are covered by Social Security, when they apply for a Social Security benefit, those years will be counted along with those earned through outside employment. In that sense, nothing is lost by leaving the government.

When can you withdraw FERS?

You can request a refund at any time after separation. Reimbursement of Retirement Deductions – Complete an Application for Reimbursement (SF-3106). If you submit the form within 30 days of separation, return it to the Benefits Office. After 30 days, return it to OPM at the address on the form.

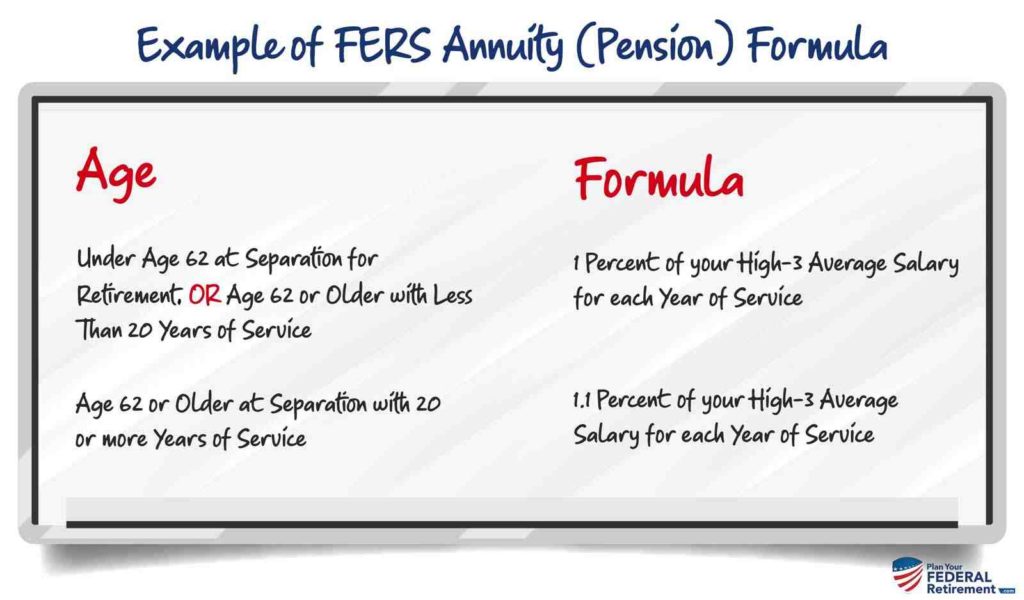

How much is FERS removal?

Most FERS employees pay 0.8% of base salary for basic FERS benefits. The agency contributes 10.7% or more to FERS. The basic FERS benefit provides retirement, disability and survivor benefits and may be reduced for early retirement or to provide survivor protection.

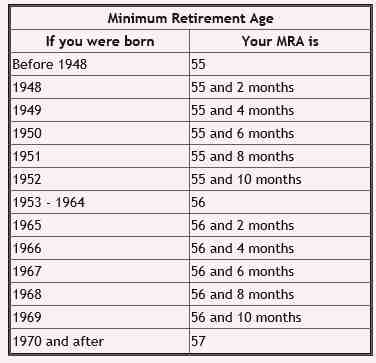

When can I collect my FERS retirement?

FERS employees are eligible for a full immediate annuity (no reduction) at age 62 with 5 years of service. With 5 or more years of service, at age 62 or older, workers can leave federal service and claim a full pension.

Can I borrow from my FERS retirement?

If you’re under FERS (Federal Employees Retirement System), you can’t borrow on any agency’s contributions or on earnings from agency contributions. Once you have met the current loan eligibility rules and your application is approved, the requested amount is withdrawn from your account.

Can federal employees borrow from their retirement?

Federal employees and members of the uniformed services may be eligible for a Thrift Savings Plan loan. A TSP loan allows you to borrow from your retirement savings to buy a home or pay for other things, but it can lead to less money overall in your TSP account.

Can I withdraw money from my FERS?

You can withdraw your basic benefit contributions if you leave federal employment. However, if you do, you will not be eligible to receive benefits based on the service covered by the reimbursement. There is no provision in the law for the reimbursement of contributions to the FERS that have been returned.

How do I withdraw my FERS retirement?

If you are leaving your federal job and want a refund of your retirement contributions, you can get an application from your personnel office, fill it out, and return it. If you are no longer in federal service, you can purchase the appropriate application on our website.

How do I get my money out of FERS?

If you have less than five years of creditable civilian service, you have 2 options:

- Leave your money in the retirement fund if you think it can go back to the Federal Government. You can request a refund at any time after separation.

- Reimbursement of Retirement Deductions – Complete an Application for Reimbursement (SF-3106).

What happens to my FERS if I leave federal service?

An employee covered by FERS who leaves Federal service is eligible to receive a deferred FERS annuity if: The employee: (1) is not eligible for an immediate retirement and FERS annuity within one month of separation; (2) meets the minimum civil service requirements of at least five years of civil service; (3) does…

What is considered a good pension?

Based on these figures, it is clear that it is advisable to aim for a pension of at least £100,000 or preferably more.

How much does the average 65-year-old have in retirement savings? Those who have retirement funds don’t have enough money in them: According to our research, people ages 56 to 61 have an average of $163,577, and those ages 65 to 74 have even less savings. 11 If that money were turned into an annuity, it would only amount to a few hundred dollars a month.

What value is a good pension?

It’s often recommended that you put about 15% of your pre-tax income into your pension each year while you work, but that’s not always possible.

Which employee is most likely to have a pension plan?

Among unionized workers, 91 percent had access to a retirement plan. That compares to 65 percent of non-union workers. Unionized workers were more likely than nonunion workers to have access to defined-benefit retirement plans.

What are three types of employer provided pensions?

Common types of retirement plans offered by employers

- 401(k) plans. This is the most common type of employer-sponsored retirement plan. …

- Roth 401(k) plan. This type of plan offers the same benefits as a traditional Roth IRA with the same employee contribution limits as a traditional 401(k) plan. …

- 403(b) plans. …

- simple plan.

What is the average pension amount?

Average Retirement Income from Pensions The average annual pension benefit ranges from $9,262 for a private pension, $22,172 for a state or local pension, $30,061 for a federal government pension, and $24,592 for a railroad pension.

What is considered a good monthly pension?

A good rule of thumb is to save enough to replace about 80% of your pre-retirement monthly income. For example, if you were earning about $5,000 a month before you retired, you can aim for an average monthly retirement income of $4,000 afterward.

What is a typical pension payout?

The average amount is $60,000. The defined benefit plan applies a pension factor of 1.5 percent. Multiply $60,000 by 1.5 percent, then multiply by 30 years of service. The amount of the annual pension amounts to $27,000. This will be paid in monthly installments.

Can I retire on $8000 a month?

Based on the 80% principle, you can expect to need about $96,000 in annual income after you retire, which works out to $8,000 per month.

How much do I need to retire with 10 000 a month?

So if you want $10,000 per month, you need to have a lump sum of $1.96 million. If you feel you have very good genes and expect to live 30 years in retirement, then the present value of that cash flow should be $269,000 per $1,000, or $2.69 million per $10,000 per month.

How much money does the average person need to retire?

Most experts say your retirement income should be about 80% of your final pre-retirement annual income. 1 That means if you make $100,000 a year in retirement, you need at least $80,000 a year to live a comfortable lifestyle after you leave the workforce.