Nine of those states that do not tax retirement plan income just because retirement plan payouts are considered income, and these nine states have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee , Texas, Washington, and Wyoming.

What is the average pension payout per month?

The median monthly Social Security income in 2021 is $ 1,543 with a 1.3 percent cost of living. How to maximize this income: Delay your receipt of these benefits until full retirement age of 67.

What is your comfortable monthly retirement income? Based on the 80% rule, you can expect to need approximately $ 96,000 in annual income, or $ 8,000 per month, when you retire.

What is a typical pension payout?

The average amount is $ 60,000. The defined benefit plan applies a pension factor of 1.5 percent. Multiply $ 60,000 times 1.5 percent, then multiply by 30 years of work. The annual amount of the pension is $ 27,000. This will be payable in monthly installments.

What is the average pension payout?

Median Retirement Income in 2021 According to US Census Data, median retirement income for retirees age 65 and older is $ 47,357. The median median retirement income is $ 73,228.

How is a pension payout calculated?

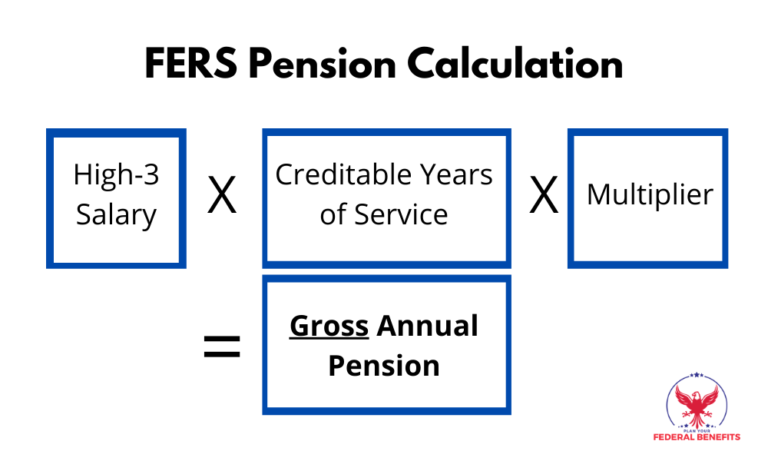

However, most will use the average of the top three salary years as the start of their payroll calculations. When that number is clear, it is multiplied by the percentage of your plan. Then you multiply the next number by the number of years you have worked with the company.

What is the average Canadian retirement income?

Median Income for Canadian Retirees. The median after-tax income is $ 61,200. This income comes from various sources such as the ones mentioned. Here’s how it breaks down: Wages, Salaries & Commissions – 27%

What is the average retirement in Canada?

| Sex | Both sexes | |

|---|---|---|

| Geography 2 | Canada (map) | |

| Years | ||

| Average age | Together, all retirees | 63.6 |

| Public sector workers 4 | 61.5 |

What is the average monthly retirement income in Canada?

The monthly average amount paid for the new retirement (age 65) in January 2022 is $ 779.32.

What is a good monthly retirement pension?

A good rule of thumb is to save enough to replace about 80% of your monthly income before retirement. For example, if you were earning around $ 5,000 a month before retirement, you could aim for an average monthly retirement income of $ 4,000.

What is a good pension amount a month?

What is Good Retirement Income? According to AARP, a good retirement income is around 80 percent of pre-tax income before you leave your job. This is because when you are no longer working, you will not pay income tax or other work-related expenses.

What does the average retiree live on per month?

Average retirement expenses by category. According to the Bureau of Labor Statistics, a U.S.-led household aged 65 and over spent an average of $ 48,791 per year, or $ 4,065.95 per month between 2016 and 2020.

How long does FERS annuity last?

When you retire, you are entitled to a monthly annuity. If you leave federal service before reaching full retirement age and have a minimum of 5 years of FERS service, you may opt for deferred retirement.

Are Federal Pensions For Life? Then, when you retire, you will receive monthly annuity benefits for the rest of your life. Congress created the Federal Employee Pension Scheme (FERS) in 1986, which entered into force on January 1, 1987. Since then, new federal civilian workers who are covered by retirement insurance are covered by the FERS.

How is FERS annuity paid out?

FERS pensions are based on the average wage 3 high. Generally speaking, the benefit is calculated as 1 percent of the average high level 3 wage multiplied by the years of trustworthy work. For those retiring aged 62 or more with at least 20 years of service, a factor of 1.1 percent applies instead of 1 percent.

How is FERS annuity paid?

Then, when you retire, you will receive monthly annuity benefits for the rest of your life. The TSP portion of FERS is an account that your agency will automatically set up for you. In each billing period, your agency pays to your account an amount equal to 1% of the basic salary you earn for the billing period.

Is FERS retirement paid monthly?

FERS Annuity Supplement This is money paid monthly until age 62. This is the equivalent of the Social Security benefit you earned as a federal government employee.

Is FERS annuity for life?

Your FERS is basically the pension you receive from the Federal Employee Pension Scheme. When you retire, you will receive monthly annuity payments from the government for the rest of your life.

Are government annuities for life?

Is my annuity? The annuity shall terminate on the date of death of the annuity or on the date of any other terminating events provided for in title 5, United States Code, section 8345 (c) et seq.

How does FERS annuity work?

Overall, the FERS benefit is 1% of the average ‘high-3’ earnings multiplied by the years and months of service. If you were at least 62 years old when you separated and had worked at least 20 years, your pension is 1.1% of your average ‘top 3’ earnings multiplied by the years and months of service.

How long does the FERS supplement last?

This supplement is paid to federal FERS employees who retire before the age of 62 and will continue to receive it until the month they turn 62. So if someone retires at 57, they will get FERS for 5 years when they are 61. the pensioner will only receive the benefit for 1 year.

Is FERS supplement being eliminated?

This special allowance, also incorrectly known as “Social Security Allowance” or “Bridge”, is designed to provide people who have earned a full FERS pension an additional source of income. In recent years, however, Congress has spoken of eliminating this supplement altogether.

What is the maximum of income when receiving FERS supplemental pay?

FERS is earnings test, which means that for every $ 2 you earn above the annual limit ($ 18,240 in 2020), your FERS allowance will be reduced by $ 1. The earnings test applies to income from work, which is usually only income earned through W-2 or self-employment.

How many years do you have to work for the federal government to get full retirement?

Most people need 40 points (10 years of work) to qualify for Social Security retirement benefits. As a federal employee, you pay full Social Security Tax of 6.2% of your salary.

Can you retire at age 20 from the federal government? Regular (immediate) retirement According to the FERS, an employee who meets one of the following age and work requirements is entitled to an immediate retirement pension: 62 after five years of service, 60 after 20, the minimum retirement age (MRA) after 30 or MRA out of 10 (but with reduced benefits).

Can I retire from the federal government after 10 years?

For a postponed retirement pension, you must be at least MRA level and have at least 10 years of service when you leave the federal government position. You are entitled to a full retirement pension from the age of 62.

Can I retire after 10 years of service?

The minimum qualifying period for receiving an old-age pension is 10 years. A central government official who retires under the pension legislation is entitled to a pension after completing at least 10 years of qualifying service.

What happens if I leave federal service before retirement age?

Employees who retire from federal service before the age of 55 must wait until they are at least 59.5 years old to withdraw their TSP accounts so that they do not face a 10 percent early retirement penalty.

How many years do you have to work to get federal pension?

You must have at least 5 years of trustworthy civil service to qualify (to qualify for Basic Benefit Plan Retirement Benefits if you leave federal service before retirement). Survivors’ and invalidity pensions are available after 18 months of civil service.

What is the average pension of a federal employee?

Defined FERS benefits are smaller – averaging around $ 1,600 a month and a median of around $ 1,300, for annual amounts of $ 19,200 and $ 15,600 – as this program also includes social security as its primary component.

Do all federal employees get a pension?

The Federal Workers’ Retirement System (FERS) is a retirement plan for all civilian workers in the United States. FERS employees receive retirement benefits from three sources: Basic Benefit Plan, Social Security, and Savings Plan (TSP).

Do federal employees get a pension and Social Security?

The FERS is a three-tier system that includes National Insurance, Federal Retirement, and Deferred Tax Savings. All employees enrolled in FERS are covered by Social Security. They participate at the current tax rate and are entitled to the same benefits as all other employees in the plan.

Can you collect a federal pension and Social Security?

Yes. Nothing prevents you from receiving both a retirement pension and Social Security benefits.

What is the average pension of a federal employee?

The average civilian federal employee who retired in fiscal 2016 was 61.5 years and 26.8 years of federal service. The average monthly annuity payment for employees who retired under CSRS in fiscal 2018 was $ 4,973. Employees who retired under the FERS received an average monthly pension of $ 1,834.

What happens to my FERS if I resign?

Since FERS employees are covered by Social Security when they claim Social Security benefits, those years will be counted along with those earned through outside employment. In this respect, leaving the government loses nothing.

What happened at Van Gend en Loos? The plaintiffs, van Gend en Loos, imported the chemicals from West Germany into the Netherlands, where they were ordered to pay import taxes at the Dutch Customs, the defendants, which they opposed, as it was contrary to the European Economic Community’s prohibition on State import duties, as per joke. 12 …

What is the main rationale of the Court’s decision in Van Gend en Loos?

The court considered that the fact that the failure of Member States to comply with EU law may be supervised by enforcement actions initiated by a commission or another Member State does not mean that natural persons should also not be able to act as enforcers before national courts. .

What are the Van Gend requirements?

Van Gend En Loos v. Nederlandse

- The recipe must be sufficiently clear and precise.

- The recipe must be unconditional.

- It must not leave room for freedom for its implementation by a national institution or body. This criterion only applies to Treaty articles.

What are the features of the new legal order created by the ECJ in Van Gend en Loos?

The new legal order was first established in two landmark cases involving Van Gend en Loos for the first time in 1963; In this case, states limit their sovereign rights to a limited extent, thus constituting an advantage for international law, the legal doctrine of supremacy emerged from the ECJ through a number of judgments.

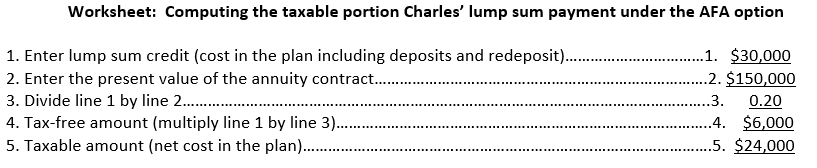

How much is FERS lump sum?

Basic Death Benefit In the event of the death of an FERS employee, the surviving spouse is entitled to a one-time death benefit equal to 50% of the deceased’s current wage plus a one-time payment of $ 34,991. (Remember that this is the approved amount for 2021 but is adjusted for inflation annually).

Can I withdraw my FERS? Withdrawal from FERS You can request a refund of your pension contributions as a lump sum payment, or you can wait until you reach retirement age to apply for your monthly pension payment.

What is the average FERS pension?

Defined FERS benefits are smaller – averaging around $ 1,600 a month and a median of around $ 1,300, for annual amounts of $ 19,200 and $ 15,600 – as this program also includes social security as its primary component.

Is FERS pension good?

This is one of the many reasons why the Federal Workers’ Retirement System is regarded as one of the best retirement packages. And to this sweet retirement plan come the perks of getting Social Security and savings plan payments.

What is a good retirement pension?

For those retiring with a retirement plan, the average annual retirement pension is $ 9,262 for the Private Retirement, $ 22,172 for the Federal Retirement, and $ 24,592 for the Railroad Retirement.

How is FERS payout calculated?

FERS (immediate or early) Generally speaking, the benefit is calculated as 1 percent of the average wage of 3 multiplied by the years of trustworthy work. For those retiring aged 62 or more with at least 20 years of service, a factor of 1.1 percent applies instead of 1 percent.

What percentage does FERS pay?

| Age | Formula |

|---|---|

| Age 62 or older, separated with 20 or more years of service | 1.1 percent of your average high-3 salary for each year you work |

How do you calculate FERS retirement?

FERS pension = 1.1% x high wage – 3 x years worked. This is equivalent to 1% – 1.1% of your highest annual salary for each year of federal service. You can maximize your benefits by paying over 30% of your pre-retirement income.

Can you take FERS as a lump sum?

Interest due on lump-sum payment of pension contributions. For Federal Employee Pension Scheme (FERS) benefit, you will receive interest on these contributions if you have worked for more than a year. Interest is paid at the same rate as for government securities.

Sources :