The SSA does not punish permanently working retirees. You will receive all the benefits that the government has withheld after you reach your full retirement. At that time, the SSA recalculates your profit amount.

How many years do you have to work in the federal government to retire?

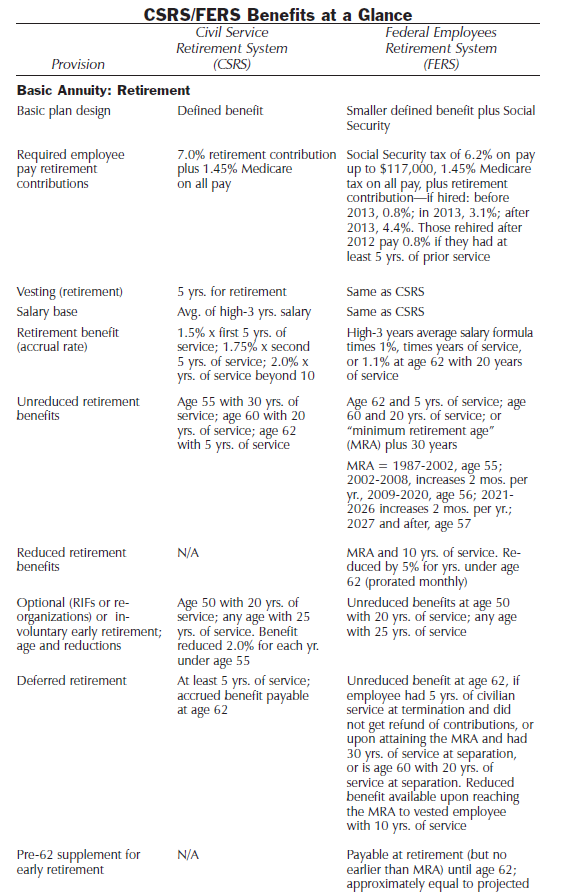

You must work for at least 5 years with the Federal Government before you are eligible for a Federal FERS Pension, and for each year you work, you will be eligible for at least 1% of your High-3 Average Salary History.

What is the average pension of a federal employee? The average civilian federal employee who retired in FY 2016 was 61.5 years old and completed 26.8 years of federal service. his average monthly annuity pay to workers who retired under CSRS in FY 2018 was $ 4,973. Workers who retired under FERS received an average monthly annuity of $ 1,834.

How many years do you need for federal pension?

To be eligible (eligible to receive your retirement benefits from the Basic Benefit Plan if you leave Federal service prior to retirement), you must have at least 5 years of credible civil service.

Can I get pension after 5 years?

This usually means that if you leave the job in five years or less, you lose all pension benefits. But if you leave after five years, you get 100% of your promised benefits. Graduated clothing. With this type of property, you are entitled to at least 20% of your profit if you leave after three years.

How many years does it take to be vested in FERS?

You need five years of service to be invested in the retirement system; only after you have been invested in the retirement system will you be eligible for annuity under any circumstances. That means five years of actual service.

Can I retire from the federal government after 10 years?

It is possible to retire from government early with only 10 years of service. But it will cost you. … Under the MRA 10 option, only 10 years of service is required to qualify for immediate retirement if you are under age 62 (but you must be at least at your MRA at the time of your separation from federal service).

What happens if I leave federal service before retirement age?

If you leave your government position before becoming eligible for retirement: you can request that your retirement contributions be returned to you in a lump sum payment, or. if you have at least five years of credible service, you can wait until you are of retirement age to apply for monthly retirement payments.

What happens to federal pension if you quit?

Because FERS employees are covered by Social Security when they apply for Social Security benefit, those years will be counted along with those they earned through outside employment. In this regard, nothing is lost by leaving government.

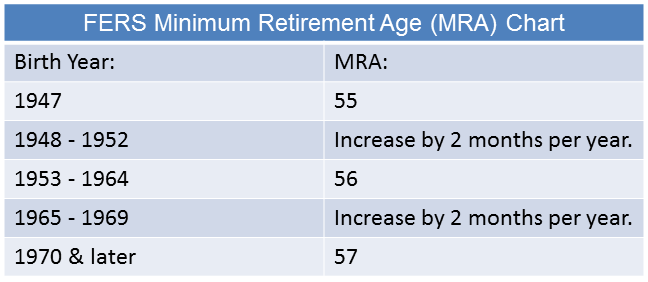

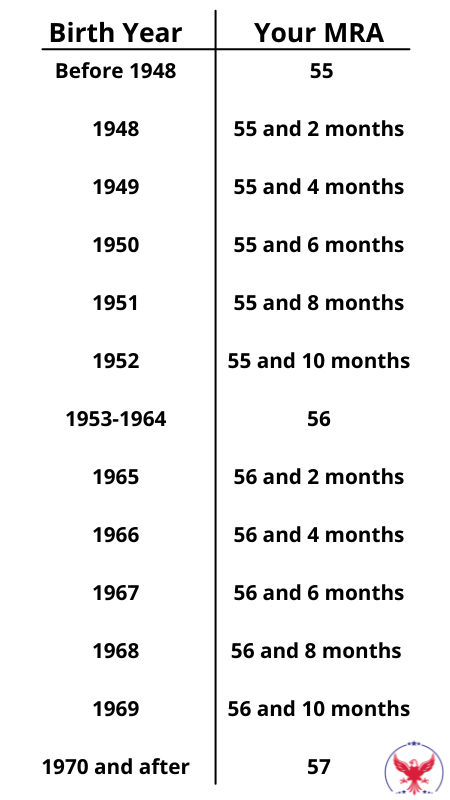

What is the minimum retirement age for federal employees?

Regular (Immediate) Retirement Under FERS, an employee who meets one of the following age and service requirements is eligible for immediate retirement: age 62 with five years of service, 60 with 20, minimum retirement age (MRA) with 30 or MRA. with 10 (but with reduced profits).

Can you retire early from federal government?

It is possible to retire from government early with only 10 years of service. … Among them is a unique option under the Federal Employees Retirement System, which allows a worker to retire at their minimum retirement age with even just 10 years of service.

What is the earliest a federal employee can retire?

Normally, an employee is entitled to retire from federal service when the employee has at least 30 years of service and has at least 55 years under the Civil Service Retirement System or 56 and two months under the Federal Employees Retirement System; has at least 20 years of service and is at least 60 years old; or have at …

How soon should I apply for Social Security before my 66th birthday?

You can apply for up to four months before you want your retirement benefits to begin. For example, if you turn 62 on December 2, you can start your benefits as early as December, and apply in August. Even if you’re not ready to retire, you should still register for Medicare three months before your 65th birthday.

How soon before you turn 66 can you apply for Social Security? You can apply for up to four months before you want your retirement benefits to begin.

What month do you get your first Social Security check?

Social Security benefits are paid the month after they are due. If you tell us you want your benefits to start in May, you will receive your first benefit check in June.

How long does it take to get my first Social Security check?

Once you apply, it could take up to three months to receive your first profit payment. Social Security benefits are paid monthly, starting in the month after the birthday when you reach full retirement (which is currently 66 and will gradually increase to 67 over the next several years).

Is Social Security paid a month behind?

We pay Social Security benefits monthly. The benefits are paid in the month after the month for which they are payable. For example, you would receive your July benefit in August.

How long does it take to get your first Social Security check after you file?

Once your application is made and submitted, you will be asked how long it takes to receive a social security approval. Usually, it takes 6 weeks to process your application and for the benefits to start.

Is your first Social Security check retroactive?

If you have already reached full retirement, you can choose to start receiving benefits before the month you apply. However, we cannot pay retroactive benefits for any month before you have reached full retirement or more than six months in the past.

How long does it take to get first Social Security check after applying?

Once you apply, it could take up to three months to receive your first profit payment. Social Security benefits are paid monthly, starting in the month after the birthday when you reach full retirement (which is currently 66 and will gradually increase to 67 over the next several years).

How long does it take to get Social Security after you apply?

Once you apply, it could take up to three months to receive your first profit payment. Social Security benefits are paid monthly, starting in the month after the birthday when you reach full retirement (which is currently 66 and will gradually increase to 67 over the next several years).

Is your first Social Security check retroactive?

If you have already reached full retirement, you can choose to start receiving benefits before the month you apply. However, we cannot pay retroactive benefits for any month before you have reached full retirement or more than six months in the past.

How long does it take for a Social Security application to be approved?

While processing times depend on the accuracy of your application and the number of applications in processing, you can generally expect it to take about six weeks to process your Social Security and start your benefits.

Can I retire at 57 and collect Social Security?

You can start your Social Security retirement benefits as early as age 62, but the amount of benefit you receive will be less than your full retirement amount.

Can a person retire at the age of 57? So, is 57 a good age to retire? The answer is both Yes and No. It is Yes because you can register for retirement at any age and the resignation varies from person to person. … At the times, most people waited until the late ’60s or early’ 70s to retire, although American citizens choose to retire much earlier.

What is the earliest age you can retire and collect Social Security?

The earliest person can start receiving retirement benefits from Social Security will remain at the age of 62. Social Security benefits are reduced for each month when a person receives benefits before full retirement age.

Can I retire at 61 and collect Social Security?

The earliest you can start collecting retirement benefits is age 62. You can apply after you reach 61 years and 9 months. However, Social Security reduces your payment if you start collecting before your full retirement age, or FRA. … (You can apply later than 70, but it doesn’t change your profit.)

Can you get Social Security if you retire at age 55?

So can you retire at 55 and collect Social Security? The answer, unfortunately, is no. The earliest age to derive retirement benefits from Social Security is 62 years.

Can a 58 year old draw Social Security?

You can start receiving your Social Security retirement benefits already at the age of 62. However, you are entitled to fully benefit when you reach your full retirement. If you delay taking your benefits from your full retirement age to the age of 70, your benefit amount will increase.

Can I retire at the age of 58?

A worker may choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after a normal retirement age can result in greater benefits.

Can you get Social Security if you retire at age 55?

So can you retire at 55 and collect Social Security? The answer, unfortunately, is no. The earliest age to derive retirement benefits from Social Security is 62 years.

Can a 55 year old collect Social Security?

So can you retire at 55 and collect Social Security? The answer, unfortunately, is no. The earliest age to start Social Security retirement benefits is 62. … Once you turn 62, you could claim Social Security retirement benefits, but your income from consulting a job could affect how much you collect.

Can you retire after 30 years of service?

Unless you receive a special exemption, federal employees must retire at 70. 7. If you have 30 years of service, you can resign and apply for a delayed retirement at age 55 (or your MRA under FERS).

How many years of service do you need to qualify for retirement? All born in 1929 or later need 40 credits to be eligible for Social Security retirement benefits. Because you can earn 4 credits a year, you need at least 10 years of work subject to Social Security to become eligible for Social Security retirement benefits.

Can I retire at 55 with 30 years of service?

You will be eligible for a service retirement benefit when you reach the age of 55 and have five or more years of credited member service. … For the full retirement grant, you must be 62 years old at retirement or, if you have 30 years of credited service, you can retire as young as 55 years old.

Can I take my pension at 55 and still work?

Can I get my pension early and continue working? The short answer is yes. Currently, there is no set retirement age. You can continue to work as long as you want, and can also access most private pensions at any age from 55 years – in a variety of different ways.

Can I take early retirement at 55?

So can you retire at 55 and collect Social Security? The answer, unfortunately, is no. The earliest age to derive retirement benefits from Social Security is 62 years.

What is the criteria for early retirement?

The common definition of early retirement is any age before 65 – that’s when you qualify for Medicare benefits. Currently, men retire at an average age of 64, while for women the average retirement age is 62.

What is considered early retirement?

A worker may choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after a normal retirement age can result in greater benefits. With delayed retirement credits, a person can get their biggest benefit by retiring at the age of 70.

How much do you lose if you retire at 65 instead of 66?

Age 65: 13.3 percent. Age 66: 6.7 percent.

Is the age 55 considered a senior citizen?

As I mentioned, 55 is the age at which you are considered an old man – at least in the eyes of many companies offering discounts. Being labeled an elderly person could make you feel old, but you should still take advantage of it.

What benefits do you get at the age of 55? Here’s how aging can save you money:

- Senior discounts.

- Travel offers.

- Tax deductions for the elderly.

- Greater retirement account limits.

- No more early withdrawal punishment.

- Social Security Payments.

- Affordable health insurance.

- Senior services.

Is age 63 considered a senior citizen?

Elderly: Variously defined as an elderly or retired person, this term generally refers to someone who is at least 60 or 65 years old. Some people consider “old” to be a patron’s expression.

Is 63 years old considered a senior?

Usually defined as an elderly or retired person, an elderly person is someone who has at least reached the age of 60 to 65 years. In most cases, the term old man is used to refer to someone who is old in society, but not in a bad way. Such a person is often regarded as wise, experienced, and worthy of respect.

What age do they classify you as a senior citizen?

For example, according to Medicare, an elderly person is 65 years of age or older. However, Social Security benefits are eligible for seniors from age 62, although the Social Security Office reports that 67 is the age of retirement. However if you are 55 years old and you visit Arby’s or McDonald’s, you can get a senior discount.

Is age 50 considered a senior citizen?

At the age of 50, you are considered a senior of the AARP. Although you may not be part of the retired community, you can become a member of the AARP as a U.S. citizen and gain access to every senior discount available. Currently, your age qualifies you for several different benefits.

At what age are you considered to be a senior citizen?

In the United States, an elderly person is generally considered to be anyone of retirement age, or a person who has reached the age of 62 or older. However, the standard threshold for Medicaid is age 65.

Is age 50 considered elderly?

The World Health Organization believes that most developed countries characterize old age from 60 years and older. However, this definition is not adaptable to a place like Africa, where the more traditional definition of elderly, or elderly, begins between 50 and 65 years of age.

How much does a GS 12 make in retirement?

How much does GS-12 earn in retirement? The salary for GS-12, Step 10, Rest of the United States, is $ 95,388 in 2018. Using this as the alt-3, and with 30 years and under 62, this equates to an annuity of $ 28,616 ($ 25,754 with survivor profit). At age 62 or older, it would be $ 31,478 ($ 28,330).

How do I calculate my GS retirement? Overall, the profit is calculated as 1 percent of a high-3 average salary multiplied by years of credible service. For those retiring at the age of 62 or later with at least 20 years of service, a factor of 1.1 percent is used rather than 1 percent.

What is the pension for a GS 12?

How much does GS 13 earn in retirement? Payment for GS-12, Step 10, Rest of the United States, is $ 95,388 in 2018. Using that maximum 3, and with 30 years and under 62, this equates to an income of $ 28,616 ($ 25,754 with survivor). profit). At age 62 or older, it would be $ 31,478 ($ 28,330).

How much does a GS 13 make in retirement?

If he retires with 30 years of service, his basic retirement from FERS will provide 30 percent of his high-three median salary. He has been on the GS 13-10 level for the last three years. His current salary is $ 113,007.

How does a GS pension work?

Your agency deducts the cost of the Basic Benefit and Social Security from your salary as salary deductions. Your agency also pays its share. Then, after you retire, you get annuity payments every month for the rest of your life. The TSP part of FERS is an account that your agency automatically sets up for you.