Is it better to quit or put in two weeks?

Although it is considered appropriate to give two weeks’ notice if you plan to quit your job, sometimes a situation arises in which you have to resign without prior notice. It’s important to think carefully when making such a serious decision and to behave professionally when you leave.

Are two weeks enough to resign? Unless you are wearing a paper hat for work, the generally accepted smoking cessation label requires that you give notice two weeks in advance before boarding the boat. But the reality is that it is rarely so cut and dry. Sometimes you have to start your new position early, and two weeks is all you can reasonably offer.

What happens when you don’t give two weeks notice?

Despite etiquette and labor standards, no law requires employees to give any notice, let alone two weeks, before they quit. While breach of contract may affect compensation or trigger a lawsuit, there is no legal protection for employers when employees decide to leave.

Can you quit without 2 weeks notice?

Do I have to give 2 weeks notice before I leave a job in California? In California, in general, there is no requirement for an employee or employer to give a two-week notice, or no notice, before leaving or finishing a job. This is because California is a state of employment “at will.”

What happens if I just quit my job without notice?

Just be aware that you may be missing out on a good referral and risk losing your professional reputation (at least within your current business). That said, if you don’t get into the habit of quitting without warning, you’re likely to be fine.

Should I put in my two weeks or just quit?

It is common for American workers to notify their employers two weeks in advance before they leave work, so many people believe that doing so is legally mandatory. It is not. No state or federal law requires you to notify your boss two weeks before you leave work.

What happens if I quit without notice?

Just be aware that you may be missing out on a good referral and risk losing your professional reputation (at least within your current business). That said, if you don’t get into the habit of quitting without warning, you’re likely to be fine.

Can I put in a 1 week notice?

When you quit a job, it is considered standard to notify your employer with two weeks notice before you leave your job. Anything less than that, whether it’s a week’s notice, a couple of days, or going out immediately, is considered a short notice.

Is it worth putting in a 2 week notice?

Why should I give you two weeks notice? Warning before leaving a business has become what was expected to be done. Your employer deserves to know when you leave well in advance. This way, both you and your employer can prepare for the next transition in a practical and fair way.

How do I survive the last two weeks of work?

Focus on your job Finish your current job so that you can leave the company on a positive note, knowing that you have completed your job to the best of your ability. Focus on producing high quality work and improving your professional reputation by doing your best until your last hour of work.

How do you get through the last two weeks of a job you hate?

Graciously giving up a job

- Offer a two-week notice. It is customary to warn your boss with two weeks notice when you intend to quit your job. …

- Go in person. …

- Be positive or neutral. …

- Be brief. …

- Offer to help with the transition. …

- Write a resignation letter. …

- Say goodbye to your co-workers.

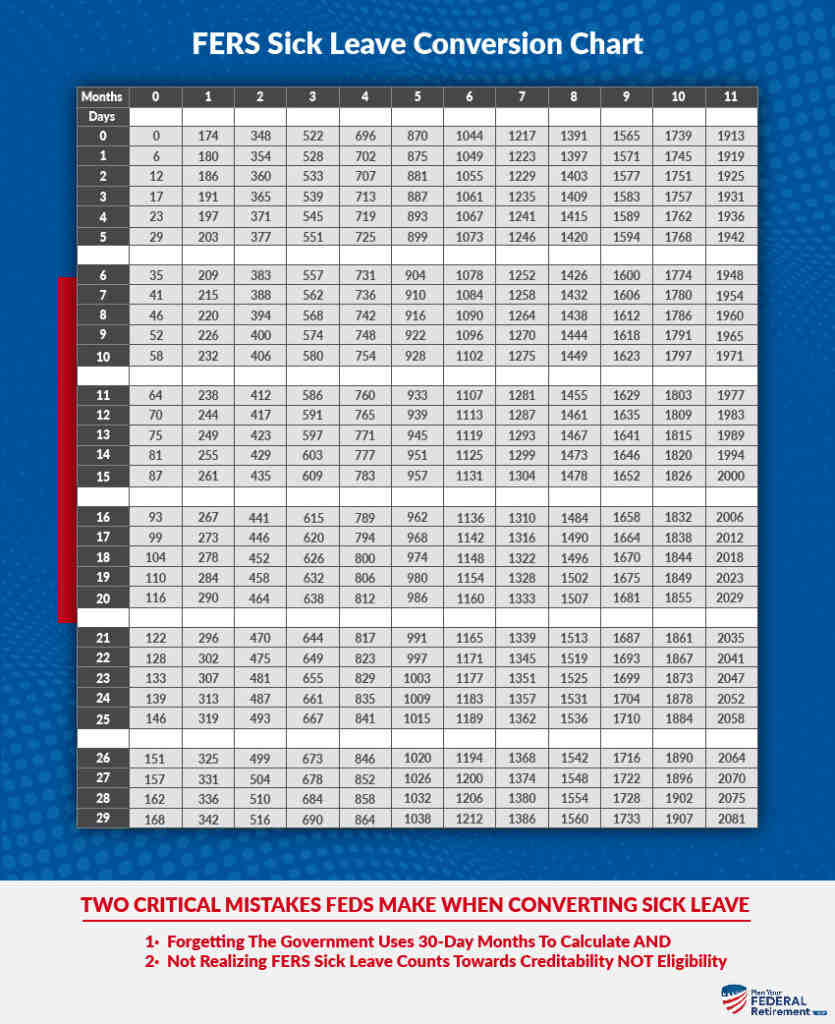

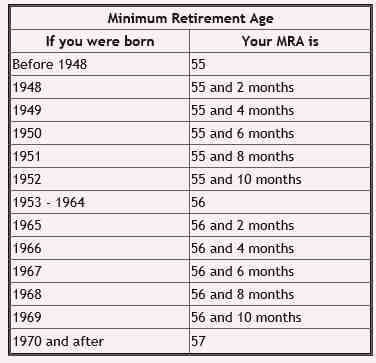

How early can I retire under FERS?

According to FERS, an employee who meets one of the following age and service requirements is entitled to an immediate retirement benefit: 62 years with five years of service, 60 with 20 years, minimum retirement age (MRA) with 30 or MRA with 10 (but with reduced performance).

How long does it take to get your first FERS retirement check?

If you are lucky (and have had an uncomplicated federal career), your retirement application will be processed and completed within five to six weeks of receipt by OPM. If you’re not so lucky, be prepared for a four- to six-month wait, and in some cases, even longer.

When should I expect my first annual FERS payment? The payment of retirees and pensioners is paid on the first of the month. However, if the first falls on a weekend or public holiday, retirees are paid on the last business day of the previous month and pensioners are paid on the first business day of the month. For example, the December 2021 retirement payment will be paid on December 30, 2021.

How is FERS retirement paid out?

Your agency deducts the cost of the basic benefit and Social Security from your salary as payroll deductions. Your agency also pays its share. Then, after retirement, you will receive annual payments each month for the rest of your life. The TSP part of FERS is an account that your agency automatically sets up for you.

How long does it take to get my FERS retirement check?

If you are lucky (and have had an uncomplicated federal career), your retirement application will be processed and completed within five to six weeks of receipt by OPM. If you’re not so lucky, be prepared for a four- to six-month wait, and in some cases, even longer.

How long does it take to get retirement money?

Advices. It usually takes about six weeks to process your Social Security retirement application, but it is recommended that you apply a few months before you need your payments.

How long does it take to get FERS withdrawal?

It took me 8 business days to receive my forms to update my FERS status. After that, it took 16 business days to update the REFUND system. From the moment the refund system is updated, the refund check takes between 30 and 45 days to be issued.

How long does it take OPM to finalize retirement?

The Retirement Service strives to complete retirement claims within sixty days. However, if we need additional information from you or your former employment agency, your claim may take longer to process.

How long does it take to get your first retirement check?

If you set benefits to start at full retirement age (FRA): 66 and 4 months for people born in 1956 and gradually increasing to 67 over the next few years, your first payment, in general , will arrive the month after the achievement. that age.

Is OPM behind in processing retirements?

OPM processed the largest number of monthly claims in April than in almost a year: a total of 11,393 retirement applications. But even as the agency progressed, the backlog was still about 28% higher than in April 2021.

Is FERS retirement the same as TSP?

If you are covered by the Federal Employee Retirement System (FERS), the TSP is part of a three-part retirement package that also includes your basic FERS annuity and Social Security.

How is FERS retirement calculated? FERS annuities (immediate or early) are based on a high average salary of 3. In general, the benefit is calculated as 1 percent of the average high pay-3 multiplied by years of credible service. For those who retire at age 62 or later with at least 20 years of service, a factor of 1.1 percent is used instead of 1 percent.

What type of retirement plan is FERS?

FERS is a retirement plan that offers benefits from three different sources: a basic benefit plan, Social Security, and a savings plan (TSP). Two of the three parts of FERS (Social Security and TSP) can accompany you to your next job if you leave the federal government before retirement.

What is the difference between retirement and TSP FERS?

With your FERS and Social Security retirement pension, you will receive fixed amounts. But with your TSP, the amount you receive depends on how much you have invested and how you have managed your money. Your TSP contributions are optional and independent of your FERS pension.

What is the difference between retirement and TSP?

The TSP is a defined contribution plan, which means that the amount of money you receive in retirement is based on the amount you put in and the return on your investment. Workers pay cash through election deferrals, and some federal agencies also make equivalent contributions.

What is my FERS retirement?

1. WHAT IS MY ANNUAL FERS? Your FERS annuity is, in short, the pension you receive from the federal employee retirement system. After retirement, you will receive monthly government annuity payments for the rest of your life.

Is TSP considered a retirement plan?

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of uniformed services, including the Ready Reserve.

Is TSP considered a 401k?

A TSP is what the federal government offers instead of a 401 (k), which is the type of plan offered by private employers. Therefore, you cannot have both a TSP and a 401 (k).

What type of plan is a TSP plan?

The Savings Savings Plan (TSP) is a tax-deferred retirement savings and investment plan that offers federal employees the same type of savings and tax benefits that many private corporations offer their employees under plans 401 (k).

How do I find out my FERS balance?

How do I know my retirement account balance? If you are a current employee, you should contact your human resources office. If you have left the federal service or are currently retired, you should contact the OPM Retirement Office at 1-888-767-6738 or retire@opm.gov.

Sources :