Can you withdraw money from FERS?

You can withdraw your basic benefit contributions if you leave Federal employment. However, if you do, you are not eligible for benefits based on a service covered by the refund. There is no requirement in the law for the redemption of FERS contributions that have been repaid.

What happens to FERS if I leave federal service? An FERS-covered employee who leaves Federal service is eligible to receive a deferred FERS annuity if: The employee: (1) is not eligible for immediate retirement and an FERS annuity within one month of separation; (2) meets the minimum civil service requirements of at least five years of civil service; (3) do …

How much is FERS removal?

Most FERS employees pay 0.8% of basic salary for basic FERS benefits. The agency contributes 10.7% or more to FERS. The basic benefit of FERS provides retirement, disability, and survivor benefits and can be reduced for early retirement or to provide survivor protection.

How much is the FERS deduction?

Overall, the basic benefit of FERS is 1% of your high-3 average salary times your years of credible service. FERS employees can currently contribute up to 11% of basic salary to the Savings Plan. An automatic government contribution adds 1% of base salary to the TSP account of each FERS employee.

How much is FERS lump sum?

Basic Death Grant When an FERS employee dies, the surviving spouse is entitled to a death grant equal to 50% of the deceased’s current salary plus a one-time payment of $ 34,991. (Note that this is the approved amount for 2021, but it is adjusted annually for inflation.)

When can you withdraw FERS?

FERS — You can claim a refund of your retirement contributions if you have been out of federal service for at least 31 days (or have held a position not covered by FERS for at least 31 days). If you have more than one year of service, interest on the contributions will be part of the refund.

Can I withdraw my FERS contributions?

Withdrawal from FERS You can request that your retirement contributions be returned to you in a lump sum payment, or you can wait until you reach retirement age to apply for monthly retirement payments.

What happens to FERS contributions if I leave government?

Because FERS employees are covered by Social Security when they apply for a Social Security grant, those years will be counted along with those they earned through outside employment. In this regard, nothing is lost by leaving government.

Can I withdraw my FERS retirement application?

A: Sure, you don’t. While you may withdraw your application to withdraw on the date you have specified, your agency may reject your application if it has a valid reason, and provide it to you in writing.

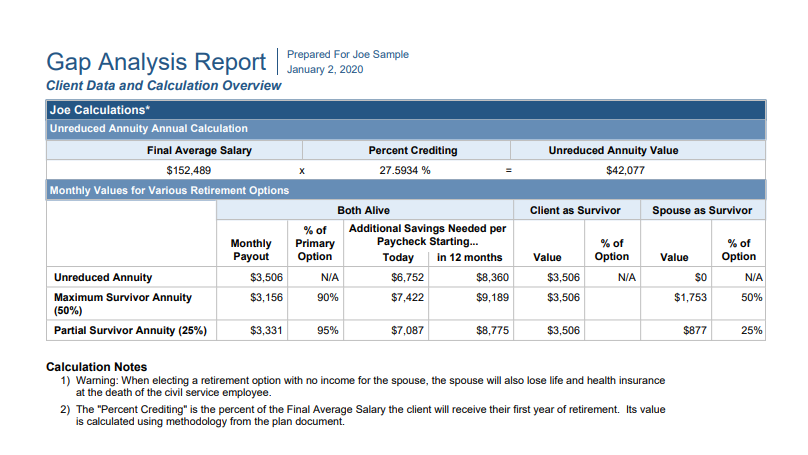

How do I calculate my FERS retirement?

FERS (Immediate or Early) FERS annuities are based on a high-3 average salary. Overall, the profit is calculated as 1 percent of a high-3 average salary multiplied by years of credible service. For those who retire at age 62 or later with at least 20 years of service, a factor of 1.1 percent is used rather than 1 percent.

What is the average FERS pension? The defined benefits of FERS are smaller – an average of about $ 1,600 per month and a median of about $ 1,300, for annual figures of $ 19,200 and $ 15,600 – as this program also includes Social Security as a basic element.

How are FERS contributions calculated?

The basic FERS benefit is calculated based on your length of service and the highest average base salary you have earned during any 3 consecutive years of service (known as the “high-3” average salary). Overall, the basic benefit of FERS is 1% of your high-3 average salary times your years of credible service.

What percentage of pay is FERS retirement?

Under FERS, workers earn retirement benefits at the rate of 1% per year; or, for FERS employees who have at least 20 years of service and who work up to age 62, the accumulation rate is 1.1% for each year of service.

What is the formula to calculate FERS retirement?

FERS pension = 1.1% x high salary-3 x years of work. This equates to 1% – 1.1% of your highest annual salary for each year of federal service. You can maximize your profit by more than 30% of your covered pre-retirement income.

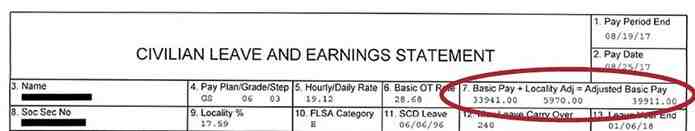

How is FERS high-3 calculated?

Computation of the FERS component

- Under 62 years of age on retirement, OR – age 62 or older with less than 20 years of service: 1: of your high-3 average salary for each year of service.

- Age 62 or older on separation with 20 or more years of service: 1.1% of your high-3 average salary for each year of service.

What is the high-3 retirement?

The high-3 for federal retirement is the three highest years of income during your federal career. Usually, your last three years of work are the highest paid, but not necessarily. Your alt-3 determines your basic federal retirement annuity, but other factors may reduce your expected retirement income.

What is the formula to calculate FERS retirement?

FERS pension = 1.1% x high salary-3 x years of work. This equates to 1% – 1.1% of your highest annual salary for each year of federal service. You can maximize your profit by more than 30% of your covered pre-retirement income.

Is FERS pension taxable?

Federal employees sometimes forget that their federal pension * is * taxable. Your CSRS or FERS Pension will be taxed at ordinary income tax rates.

What is the federal income tax return? Both your income from these retirement plans and your earned income are taxed as ordinary income with rates of 10% to 37%. 5 And if you have an employer-funded pension plan, that income is also taxed.

Where are federal pensions not taxed?

But again, there are many states (14 to be exact) that do not tax pension income at all. These include Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, New Hampshire, Alabama, Illinois, Hawaii, Mississippi, and Pennsylvania.

Are federal pensions taxed?

Federal employees sometimes forget that their federal pension * is * taxable. Your CSRS or FERS Pension will be taxed at ordinary income tax rates. Now – you will receive your contributions free of charge (because you already paid taxes on the money when it was deducted from your paycheck).

What are the 13 states that don’t tax pensions or Social Security?

States without pensions or Social Security taxes include:

- Alabama.

- Alaska.

- Florida.

- Illinois.

- Mississippi.

- Snowfall.

- New Hampshire.

- Pennsylvania.

How can I avoid paying tax on my pension?

Employers of most pension plans must withhold a mandatory 20% of your total retirement allowance when you leave their company. However, you can avoid this tax if you make a direct transfer of those funds to an IRA conversion account or other similarly qualified plan.

How much can a retired person earn without paying taxes in 2020?

For retirees 65 and older, this is when you can stop registering taxes: Single retirees earning less than $ 14,250. Married retirees posing together who earn less than $ 26,450 if one spouse is 65 or older or who earn less than $ 27,800 if both spouses are 65 or older. Married retirees posing separately who earn less than …

How much will my pension be taxed?

Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%. Public and private pension income is fully taxed.

Do I have to pay taxes on my federal pension?

Pension Income Taxes You will be subject to federal income tax at your regular rate while you receive the money from pension annuities and periodic pension payments. But if you take a direct lump sum payment of your pension instead, you have to pay the total tax due when you file your return for the year you receive the money.

How much of my federal pension is taxable?

In my experience – your contributions usually amount to about 2% to 5% of your annual pension income for FERS and about 5% to 10% for CSRS. So that means about 90% to 98% of your FERS or CSRS pension. will be taxed. So most of your FERS or CSRS pension will be taxable.

How long does it take to get your first FERS retirement check?

If you are lucky (and you have had an uncomplicated federal career), your retirement claim will be processed and finalized within five to six weeks of being received at OPM. If you’re not so lucky, be prepared for a four- to six-month wait — and in some cases, even longer.

How is FERS retirement paid out? Your agency deducts the cost of the Basic Profit and Social Security from your salary as payroll deductions. Your agency also pays its share. Then, after you retire, you get annuity payments every month for the rest of your life. The TSP part of FERS is an account that your agency automatically sets up for you.

When should I expect my first FERS annuity payment?

Retired and interest-bearing payment is due on the first of the month. However, if the first falls on a weekend or holiday, retirees are paid on the last working day of the previous month and renters are paid on the first working day of the month. For example, a payment to retirees by December 2021 will be paid on December 30, 2021.

How long does it take OPM to process my retirement 2022?

Federal retirement claims for processing have declined for the third consecutive month. The Office of Personal Management reported that the average monthly processing time for April for claims was 80 days, less than 82 days for March and 89 days for February.

How is FERS annuity paid out?

FERS annuities are based on a high-3 average salary. Overall, the profit is calculated as 1 percent of a high-3 average salary multiplied by years of credible service. For those who retire at age 62 or later with at least 20 years of service, a factor of 1.1 percent is used rather than 1 percent.

How long does it take to get first pension check?

Once the application has been submitted, the Retirement Board must wait for the final payroll of the member’s unit, which may last up to six weeks from the date of retirement. The down payment can be up to two to three months from the date of retirement.

How long does it take for CPP to start?

You should apply before you want your pension to start. How long does it take to receive a CPP after applying? It takes approximately 7 to 14 days for online applications, 120 days for applications delivered by mail or in person to Service Canada Center.

Do I have to claim my state pension or is it paid automatically?

How can I claim my State Pension? You will not automatically receive your State Pension – you must claim it. You should receive a letter no later than two months before you reach the age of the State Pension, telling you what to do. If you do not receive a letter, you can still make a claim.

How long does it take to receive FERS retirement?

How long will it take to process my federal retirement application? It takes about 60 days (2 months) to process applications for common cases. Your application may take longer if: We need more information from you or your former employment agency.

How long does it take to receive your first retirement check?

If you set benefits to start at full retirement age (FRA) – 66 and 4 months for people born in 1956 and gradually rising to 67 over the next few years – your first payment will generally arrive in the month after you reach it. that age.

How long does it take OPM to finalize retirement?

Retirement Services strives to complete retirement requirements within sixty days. If we need further information from you or your former employment agency, your claim may take longer.

Can you collect a pension and Social Security at the same time?

Yes. There is nothing stopping you from receiving both pension and Social Security benefits. But there are certain types of pensions that can reduce Social Security payments.

What types of pensions affect Social Security benefits? Your Government Pension Can Affect Social Security Benefits (En español) The Government Pension Offset, or GPO, affects spouses, widows and widowers with pensions from federal, state or local government work. It reduces their Social Security benefits in some cases.

Does Social Security decrease if you have a pension?

Does a pension reduce my Social Security benefits? In the vast majority of cases, no. If the pension is from an employer who withheld FICA taxes from your wages, as almost everyone does, it will not affect your Social Security retirement benefits.

What income reduces Social Security benefits?

If you are younger than the full retirement age and earn more than your annual income limit, we can reduce your earnings. If you are under full retirement age throughout the year, we deduct $ 1 from your earnings for every $ 2 you earn over the annual limit. By 2022, that limit is $ 19,560.

Can you collect Social Security and a pension?

Yes. There is nothing stopping you from receiving both pension and Social Security benefits.

When you retire do you get your pension and Social Security at the same time?

If two-thirds of your government pension is more than your Social Security, your benefit could be reduced to zero. If you take your government pension annuity in full, Social Security will calculate the reduction as if you were choosing to receive monthly profit payments from your government job.

Is your pension and Social Security the same thing?

Fewer companies offer guaranteed pensions but offer workers 401 (k) plans that are self-directed investments intended to generate retirement income. Social Security is a government-guaranteed basic income for older Americans, funded by a special tax paid by employees and employers.

Can I collect my Social Security and my pension at the same time?

Yes. There is nothing stopping you from receiving both pension and Social Security benefits.

Does a pension count as earned income?

Earned income also includes net income from self-employment. Earned income does not include amounts such as pensions and annuities, social benefits, unemployment benefits, workers’ compensation benefits or social security benefits.

Does a private pension count as earned income?

This means that when you take money from your pension, it counts as ordinary income (as if it were a salary).

Is pension classed as earned income?

How is pension income taxed? A pension income or through a life annuity, a retirement pension or a retirement tax is taxed as “Garage Income”. This means that the payer of the income must operate Pay As You Earn (PAYE).

Sources :