How much should I have in my TSP at 40?

How much should I have in my TSP up to 40? Savings Goals for Retirement By age 40, you should have three times your annual salary. At age 50, six times his salary; at age 60, eight times; and at age 67, 10 times. 8ï » If you reach the age of 67 and earn $75,000 a year, you should have $750,000 saved.

How much should I have in my TSP at 45? At age 45, experts recommend that you have the equivalent of four times your annual salary in the bank if you plan on retiring at 67 and maintaining a similar lifestyle, according to a recent report by financial services firm Fidelity.

What is the average TSP balance by age?

| Was | Average contribution rate | average balance |

|---|---|---|

| 60-69 | 11% | $182,100 |

| 70-79 | 12% | $171,400 |

| All ages | 9% | $95,600 |

How many TSP is a millionaire?

In the last quarter of 2021, the number of millionaires investing in the Thrift Savings Plan (TSP) has significantly increased by nearly 50%. As of December 31, there were 112,880 TSP millionaires, up from 75,420 a year ago, according to the Federal Retirement Thrift Investment Board.

How much should I have in my TSP by age 50?

By age 40, you should have three times your annual salary. At age 50, six times his salary; at age 60, eight times; and at age 67, 10 times. 8 If you reach age 67 and are earning $75,000 a year, you should have $750,000 saved.

How much do 40 year olds have saved for retirement?

How much do 40-year-olds actually have in retirement savings? The average 401(k) balance for Americans ages 40 to 49 is $120,800 in Q4 2020, according to data from Fidelity’s retirement platform. Americans in this age group contribute an average of 8.9% of their wages.

How much should I have saved for retirement by age 40?

By age 40, you should have three times your annual salary. At age 50, six times his salary; at age 60, eight times; and at age 67, 10 times. 8 If you reach age 67 and are earning $75,000 a year, you should have $750,000 saved.

How much do most 40 year olds have saved?

According to this research by the Transamerica Center for Retirement Studies, the average retirement savings by age in the US is:

- Americans in their 20s: $16,000.

- Americans in their 30s: $45,000.

- Americans in their 40s: $63,000.

- Americans in their 50s: $117,000.

- Americans in their 60s: $172,000.

How much should I have in my TSP when I retire?

If you want your TSP balance to be able to generate an annual inflation-indexed income of $10,000, most financial planners will suggest that you have a balance of $250,000 by the time you retire.

How much should I have in my TSP at 60?

To retire at age 67, experts at retirement plan provider Fidelity Investments say you should have eight times your income saved by the time you turn 60.

How much should I have in my TSP at age 50?

Savings Goals for Retirement By age 40, you should have three times your annual salary. At age 50, six times his salary; at age 60, eight times; and at age 67, 10 times. 8 If you reach age 67 and are earning $75,000 a year, you should have $750,000 saved.

Is s fund good?

Why should I invest in Fund S? While investing in the S Fund is risky, it also offers the opportunity to earn equity in US small and medium-sized companies. It provides an excellent means of further diversifying your domestic equity holdings.

What does class S mean in funds? S S shares are former no-load share classes that have been closed to new investors. If an investor wants to buy one of these funds for the first time, he will have to go through a brokerage firm and choose A, B or C share classes.

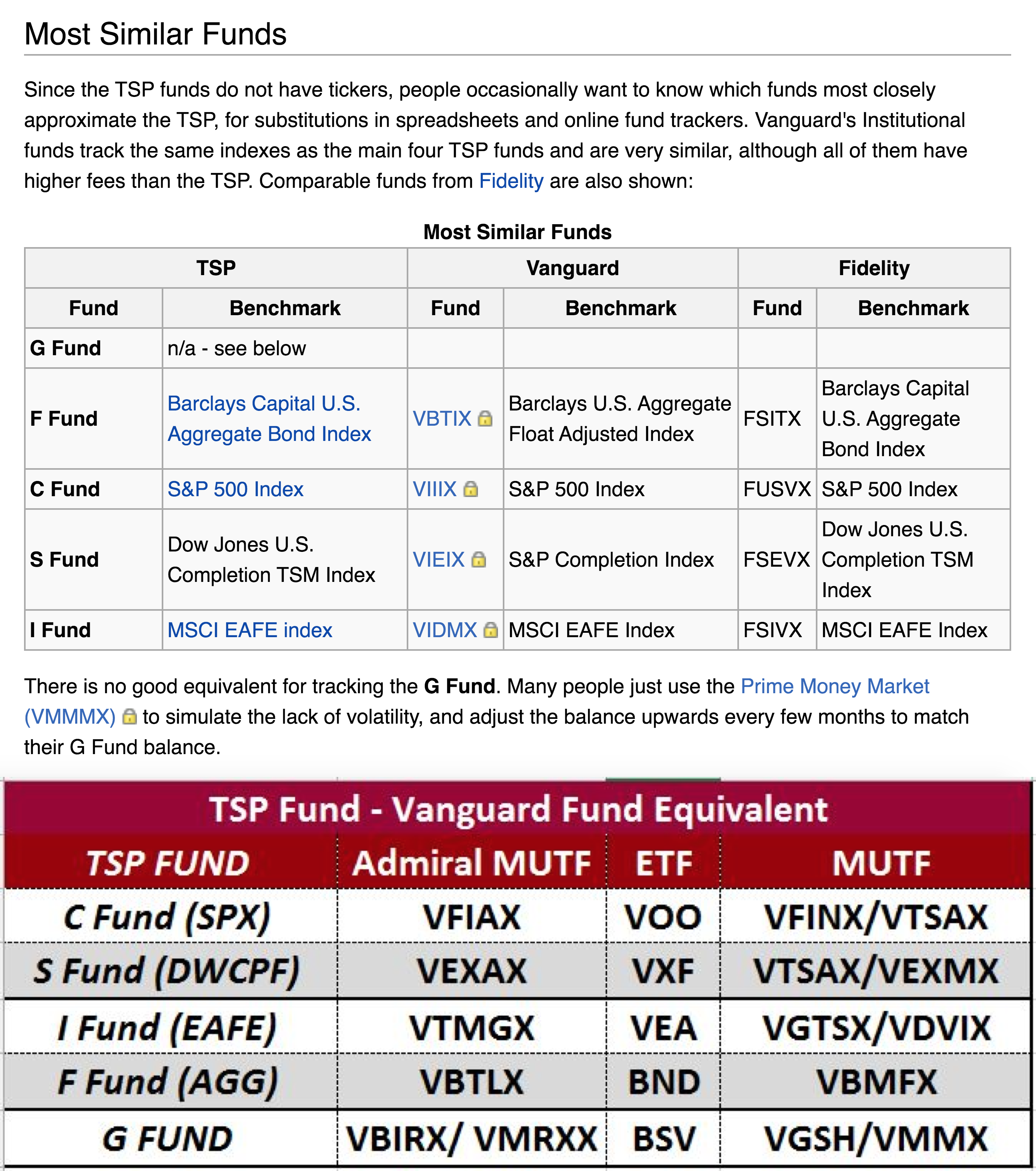

What is the S fund equivalent to?

For fund S, the alternatives are the Vanguard Extended Market ETF (VXF) or the Fidelity Extended Market Index Fund (FSMAX) for a mutual fund.

What index does the S fund follow?

The investment objective of the S Fund is to match the performance of the Dow Jones U.S. Completion Total Stock Market Index, a broad market index comprised of small and medium-sized US stocks not included in the S&P 500 Index.

What fund represents the S&P 500 for the TSP?

The C Fund owns all the stocks included in the S&P 500 index with practically the same weights they have in the index. The C Fund’s performance is measured based on how closely its returns match those of the S&P 500 Index.

What does the S fund invest in?

The Small Capitalization Stock Index (S) Fund The S Fund is invested in an equity index fund that tracks the Dow Jones U.S. Completion Total Stock Market (TSM). This is a market index of US small and medium-sized companies that are not included in the S&P 500 index.

What does the S fund TSP mirror?

The “S” in S-fund stands for “small company stocks”, but includes companies with market capitalizations considered to be medium and large. Tracking the Dow Jones U.S. Completion Total Stock Market Index, the S-fund includes stocks from across the stock market, excluding the S&P 500.

Is the S fund a good investment?

As the S Fund is passively managed, it remains fully invested during all market cycles and economic conditions. While equities have historically proven to be a good hedge against inflation, there is no guarantee that an investment in the S Fund will grow enough to offset inflation in the future.

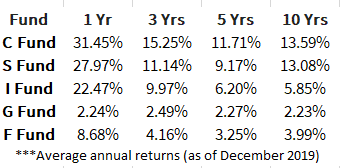

What is better C or S fund TSP?

As of December 31, 2020, the S Fund has outperformed the C Fund in the last 1, 3, 5, 15 and 20 year periods. The C Fund has outperformed by a small amount in the last 10 years. Despite the S Fund’s track record of outperforming the C, TSP participants invest three times more in the C Fund than the S Fund.

What fund should my TSP be in?

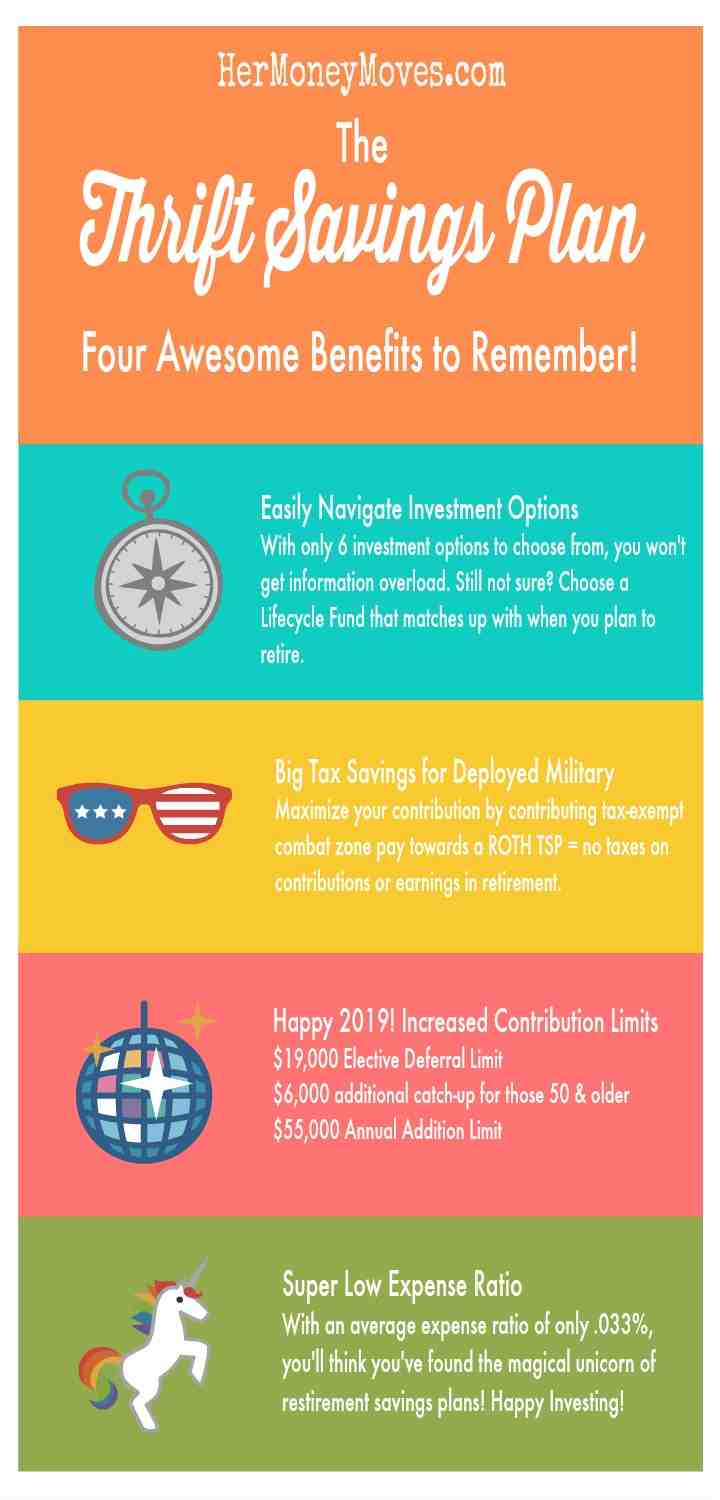

How much should I contribute to my TSP? A common suggestion of how much to save for retirement is at least 15% of your income. Others believe that the minimum should be what maximizes your employer’s contribution; in the case of TSP funds, this would be 5% of your income.

What is the difference between C and S fund?

While the C-Fund invests in companies that are included in the S&P 500, the S-fund includes companies that are smaller than those that would be found in the C-fund. The “S” in S-fund stands for “small company stocks”, but includes companies with market capitalizations considered to be medium and large.

What is the TSP C fund invested in?

The Common Stock Index Investment Fund (C) Fund C is invested in an equity index fund that tracks the Standard & Poor’s 500 Index (S&P 500). This is a broad market index comprised of the stocks of 500 large and medium-sized US companies.

What is the C fund in the TSP based on? The C Fund owns all the stocks included in the S&P 500 index with practically the same weights they have in the index. The C Fund’s performance is measured based on how closely its returns match those of the S&P 500 Index.

What are the TSP funds invested in?

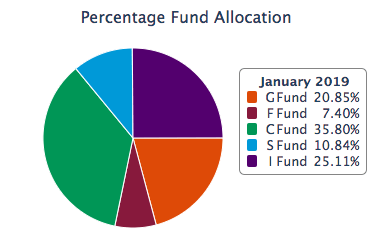

the funds (G, F, C, S and I Funds) offer a wide range of investment options, including government bonds, domestic and foreign bonds and equities. It is generally best not to put all your eggs in one basket.

What makes up the TSP F fund?

The TSP F Fund is a US bond index fund. The fund uses a “passive management” (indexing) investment approach, designed to match the performance of Barclays Capital U.S. Aggregate Bond Index, a broad index representing the US bond market. Fund F offers broad exposure to US investment grade securities.

What is the best fund in TSP?

The Lifecycle (L Funds) with the highest returns were the most aggressive funds as their percentage of shares in the account is the highest. This means that the L 2065, L 2060 and L 2055 provided investors with the best annual returns (19.90%). The L 2050 fund had an excellent return of 16.34% and the L 2045 returned 15.4%.

What does the C fund Track in TSP?

The TSP C Fund (Common Stock Index Investment Fund) is invested in large cap US equities. It tracks the Standard & Poor’s 500 (S&P 500) stock index. The TSP S Fund (Small Capitalization Stock Index Fund) is invested in equities of US small and medium-sized companies.

What index does the C fund Track?

Summary: The TSP C Fund (Common Stock Index Investment Fund) is a large cap US equity index fund that tracks the S&P 500 index. The TSP C Fund is a US equity index fund invested in the common stock of 500 companies in the Standard & Poor’s 500 (S&P 500) index.

What does the TSP C fund track?

Fund C is invested in an equity index fund that tracks the Standard & Poor’s 500 (S&P 500) Index. This is a broad market index comprised of the stocks of 500 large and medium-sized US companies. It offers you the potential to realize the greatest investment returns associated with equity investments.

What is the C fund invested in?

The Common Stock Index Investment Fund (C) Fund C is invested in an equity index fund that tracks the Standard & Poor’s 500 (S&P 500) Index. This is a broad market index comprised of the stocks of 500 large and medium-sized US companies.

What is in C fund?

The Common Stock Index Investment Fund (C) Fund C is invested in an equity index fund that tracks the Standard & Poor’s 500 (S&P 500) Index. This is a broad market index comprised of the stocks of 500 large and medium-sized US companies. It offers you the potential for high long-term investment returns.

Is the C fund a mutual fund?

A mutual fund version of Fund C could be the Fidelity 500 Index Fund (FXAIX). All of these funds have low costs equivalent to the C fund. The S Fund is the Dow Jones U.S. Completion Total Stock Market Index, which is a broad market index comprised of stocks of US companies not included in the S&P 500 Index.

How is the F fund doing?

On tsp.gov, you can learn that Fund F has so far been compounded at 7.0% per annum since it became available in January 1988. And it has done so with a maximum tolerable reduction of -6.6%.

Which is better G fund or F fund? The main difference between the two funds is that the G is invested in short-term government bonds, and the F tracks an aggregate bond index fund. Fund F offers a higher return than Fund G, but with a little more risk. However, the risk is still lower than other individual funds in the TSP.

How are the TSP funds doing?

So far this year, the S Fund is at 18.83% in the red. And C Fund’s common stock is down 8.72% last month, bringing its 2022 losses to 12.91%. Fund I, composed of international investments, lost 6.39% in April, reducing its performance this year to -12.73%.

What funds are doing well in TSP?

Fund C is up – the top TSP Core Fund in 2021 The S&P 500 index fund ended near an all-time high and is up about 3% on the month. As this index fund is the one that Fund C is based on, Fund C also performed well. C Fund rose 3.03% in August – the highest return of any major TSP fund for the month.

Is TSP up or down?

| BACKGROUND | PRICE | Year to date |

|---|---|---|

| L 2060 | $13.6051 | -8.58% |

| L 2065 | $13.6048 | -8.58% |

Is the F fund a good investment?

Why should I invest in Fund F? Investors in Fund F are rewarded with the opportunity to earn higher rates of return over the long term than they would with investments in short-term securities such as Fund G.

What type of company is Natixis?

Natixis is a French business and investment bank. It provides wholesale banking, investment solutions and specialist financial services.

Who is Natixis owned by?

Banques Populaires and Caisses d’Epargne: each holds 50% of the capital of BPCE. BPCE: central body of the Group. The BPCE subsidiaries, including Natixis, Banque Palatine, Oney and the subsidiaries grouped in the Financial Solutions & Expertise division.

What is the safest fund in TSP?

The G Fund is invested in short-term US Treasury bonds specially issued to the TSP. Payment of principal and interest is guaranteed by the US government. Thus, there is no “credit risk”.

What is the lowest risk TSP fund?

The G Fund: This fund is considered the lowest risk investment option among the TSP fund options. While investment returns are historically very low, this fund invests in short-term US Treasuries and there is very little risk of losing money in this fund.

What fund should my TSP be in?

How much should I contribute to my TSP? A common suggestion of how much to save for retirement is at least 15% of your income. Others believe that the minimum should be what maximizes your employer’s contribution; in the case of TSP funds, this would be 5% of your income.

What is the average TSP balance by age?

| Was | Average contribution rate | average balance |

|---|---|---|

| 60-69 | 11% | $182,100 |

| 70-79 | 12% | $171,400 |

| All ages | 9% | $95,600 |

How much should I have in my TSP at age 50? By age 40, you should have three times your annual salary. At age 50, six times his salary; at age 60, eight times; and at age 67, 10 times. 8 If you reach age 67 and are earning $75,000 a year, you should have $750,000 saved.

What is the average TSP account?

Average TSP account balances for uniformed service members reached nearly $30,000 by the end of 2019, while balances for new entrants to the ‘Combined Retirement System’ (BRS) came close to $7,000 in just two years. since the BRS started operating.

How much does the average person have in their TSP when they retire?

There are 3.6 million participants in the Federal Employee Retirement System, with an average end-2020 account balance of $164,000. See the article: How do you become a millionaire on TSP?.

How many TSP is a millionaire?

In the last quarter of 2021, the number of millionaires investing in the Thrift Savings Plan (TSP) has significantly increased by nearly 50%. As of December 31, there were 112,880 TSP millionaires, up from 75,420 a year ago, according to the Federal Retirement Thrift Investment Board.

Sources :