What are the 3 main types of pensions?

Three types of pensions

- Pension with a defined contribution. Sometimes referred to as “buy money” retirement or referred to as a retirement pool, these programs are very popular today. …

- Defined benefit pension. This type of pension scheme has lost its popularity. …

- State pension.

What are the main types of retirement plans? There are two main types of retirement plans: a defined benefit plan and a defined contribution plan. The Defined Benefit Scheme provides you with a fixed monthly annuity (or a lump-sum payment upon retirement). The defined contribution program creates an investment account that grows over the years of work of the employee.

What are examples of pensions?

For example, a retirement plan may pay 1% for each year a person has worked and their average earnings over the last five years of employment. 2 Thus, an employee with 35 years of service with this company and an average salary of $ 50,000 in the past year would receive $ 17,500 per year.

What are the three types of pension plans?

Defined benefit pension plans can be further classified into three types: single employer, multi-employer and a multiple cost sharing.

Is a 401k a pension?

What’s the difference between the Retirement Plan and the 401 (k) Plan? The retirement plan is financed by the employer and the 401 (k) is financed by the employee. (Some employers match some of your 401 (k) contributions.) 401 (k) allows you to control your contributions to the fund, unlike a retirement plan.

How many types of pension do we have?

There are 2 main types of pension plans: defined benefit (DB) and defined contribution (DC).

What are the 3 main types of pensions?

There are three main types of pensions. State pensions (paid by the government), ‘occupational’ pensions (your work pension) and private / personal pensions (which is written on the tin).

How do I know what type of pension I have?

If you know you have a retirement pension but are unsure what type of retirement plan this is, your best bet is to contact your pension provider. They will be able to provide you with all the details of your program, including its type, the fees you pay and what your pension looks like.

How long can you live in France without becoming a resident?

If you are staying in France for more than three months, you will need a residence permit (carte de séjour).

Can I just go away and live in France? After obtaining a long-term visa, you can apply for a residence permit in France (the so-called Carte de Sejour). Carte de Sejour is a physical card that contains your photo and signature. Usually, it is issued for a period longer than the visa.

Can you live in France without being a citizen?

If you live in France after January 1, 2021, you will have to apply for a long-stay visa, a residence permit and a work permit, if necessary, under the same conditions as a non-EU citizen.

How can I legally live in France?

People who want and can live in France without working or studying can apply for a long-stay visa and then for a séjour card. Be warned: this is not for the faint of heart. It requires proof of financial resources, private medical insurance, a police clearance and huge documentation.

Can I live in France permanently?

Permanent Residence and Citizenship If you are the spouse of a French citizen or foreigner with a residence card, or you are the parent of a French child living in France, you can apply for permanent residence in France after three years.

How long can British citizens stay in France?

If you spend 90 days or less in six months in French property, you will not need a French visa. This is because UK residents can make short-term visits (maximum 90 days with a 180-day period) throughout the Schengen area after Brexit.

How long can I stay in France for as a UK resident?

How long can UK residents stay in France without a visa? UK residents may stay up to 90 days. If you are a UK resident and want to stay in France for more than 90 days, you should apply for an EU residence permit in France through the French Consulate General in London.

Can I stay in France for 6 months?

Applying for a temporary long-stay Schengen visa (VLS-T) Reminder: The temporary long-stay visa (VLS-T) is valid for 4-6 months. Applies to foreigners who want to stay in France to take part in a short educational program, work as an artist or stay in France without a job.

How long can I stay in France as a non resident?

If you are staying in France for more than 90 days, you must apply for a long-stay visa in advance. In this case, your nationality does not exempt you from the requirements. Regardless of the duration of the intended stay, the duration of a long-stay visa must be from three months to one year.

Can I stay in France for 6 months?

Applying for a temporary long-stay Schengen visa (VLS-T) Reminder: The temporary long-stay visa (VLS-T) is valid for 4-6 months. Applies to foreigners who want to stay in France to take part in a short educational program, work as an artist or stay in France without a job.

How long can UK citizens stay in France?

How long can UK residents stay in France without a visa? UK residents may stay up to 90 days. If you are a UK resident and want to stay in France for more than 90 days, you should apply for an EU residence permit in France through the French Consulate General in London.

Do Americans working abroad pay Social Security tax?

Living abroad and taxes – you have to pay no matter where you live or work. Yes, that’s true – if you are a US Citizen or Green Card holder, you will have to pay (and are covered by) Social Security whether or not you live in the US.

What taxes do US citizens pay when working abroad? Yes, if you are an American living abroad as a US Citizen, you must file a US Federal Tax Return and pay US taxes on your worldwide income no matter where you live at the time. In other words, you are subject to the same income tax laws as people living in the United States.

Do US citizens living abroad get Social Security?

If you are a US citizen, you may receive Social Security benefits outside of the United States, as long as you qualify for them.

What countries do not tax US Social Security benefits?

If you are a non-resident alien and receive US Social Security benefits and live in Canada, Egypt, Germany, Ireland, Israel, Italy, Japan, Romania or the UK, you will not be taxed by the US on your benefits.

Do I lose my Social Security if I move to another country?

Retirees who are US citizens are entitled to benefits as long as they live outside the United States. However, foreign nationals who receive National Insurance may have some limitations on how long they can receive benefits outside of the United States.

Do US citizens living abroad need to pay taxes?

Yes, U.S. citizens must pay taxes on their overseas income if they meet the application thresholds, which are generally equivalent to the standard deduction for filing status. You may wonder why US citizens pay taxes on income earned abroad. US taxes are based on citizenship, not your country of residence.

How can I avoid paying US taxes abroad?

US Tax Avoidance While Abroad You must renounce your citizenship to a diplomatic or consular officer at an embassy. You must sign a declaration of voluntary renunciation of US citizenship and file it with the Department of State.

How long do you have to live outside the US to avoid taxes?

This test has been well covered and is a very common tax strategy for most expats. According to the IRS, if you live outside the United States for 330 days or more out of 365, you can exempt $ 101,300 in income from annual taxes.

Do I pay Social Security tax if I work abroad?

If you are part of a growing number of Americans who spend part of their careers working outside the United States, both the United States and the foreign social security system cover your work. Normally, you would have to pay National Insurance taxes for the same job in both countries.

Do you pay Social Security on foreign earned income?

People employed in the United States by a foreign employer are usually subject to withholding tax on Social Security and Medicare withholding by the foreign employer.

Does working overseas affect Social Security?

If you work abroad for a US company or, in some cases, a foreign company affiliated with a US company, you and your employer may have to pay National Insurance taxes both in the US and abroad on the same earnings.

Are taxes high in France?

France is also one of the European countries with the highest tax burden on high-income individuals. The highest rate of income tax with subsidies is 51.5% for 2021, which places France in sixth place, behind Denmark, Greece, Belgium, Portugal and Sweden.

Are taxes in France higher than ours? The United States has the highest tax rate of 39.6% since 2016. In France, the highest tax rate is 50.2% as of 2016.

Do French people pay a lot of taxes?

| French income tax ranges | French tax rate |

|---|---|

| € 74 546 € 160 366 | 41% |

| € 160,367 and more | 45% |

Do the French pay high taxes?

Therefore, France still belongs to the OECD countries with the highest tax rate. Taxes account for 45% of GDP compared to 37% on average in OECD countries. The overall rate of social security and average wage tax in 2005 was 71.3% of gross wages, the highest in the OECD.

How much does the average person pay in taxes in France?

In France, the average single worker had to pay an average net tax rate of 27.3% in 2020, compared to the OECD average of 24.8%. In other words, in France, the average single worker, net of taxes and benefits, was 72.7% of his gross salary, compared to the OECD average of 75.2%.

How much tax do you pay in France?

2. Exemption thresholds 2022 (2021 Income) In practice, only 44% of the French population pays any income tax; only about 14% pay 30%, and less than 1% pay 45%.

Are taxes higher in France or UK?

United Kingdom Higher earners pay income and social security taxes which are the same as in the United States, Australia and Spain but significantly lower than in France, Sweden and Ireland.

How much tax do you pay on your salary in France?

The rates are progressive from 0% to 45% plus an additional tax of 3% on the portion of income over EUR 250,000 (EUR) for a single person and EUR 500,000 for a married couple and 4% for income over EUR 500,000 for a single person and EUR 1 million euro for marriage.

What is France’s highest tax rate?

The rates are progressive from 0% to 45% plus an additional tax of 3% on the portion of income over EUR 250,000 (EUR) for a single person and EUR 500,000 for a married couple and 4% for income over EUR 500,000 for a single person and EUR 1 million euro for marriage.

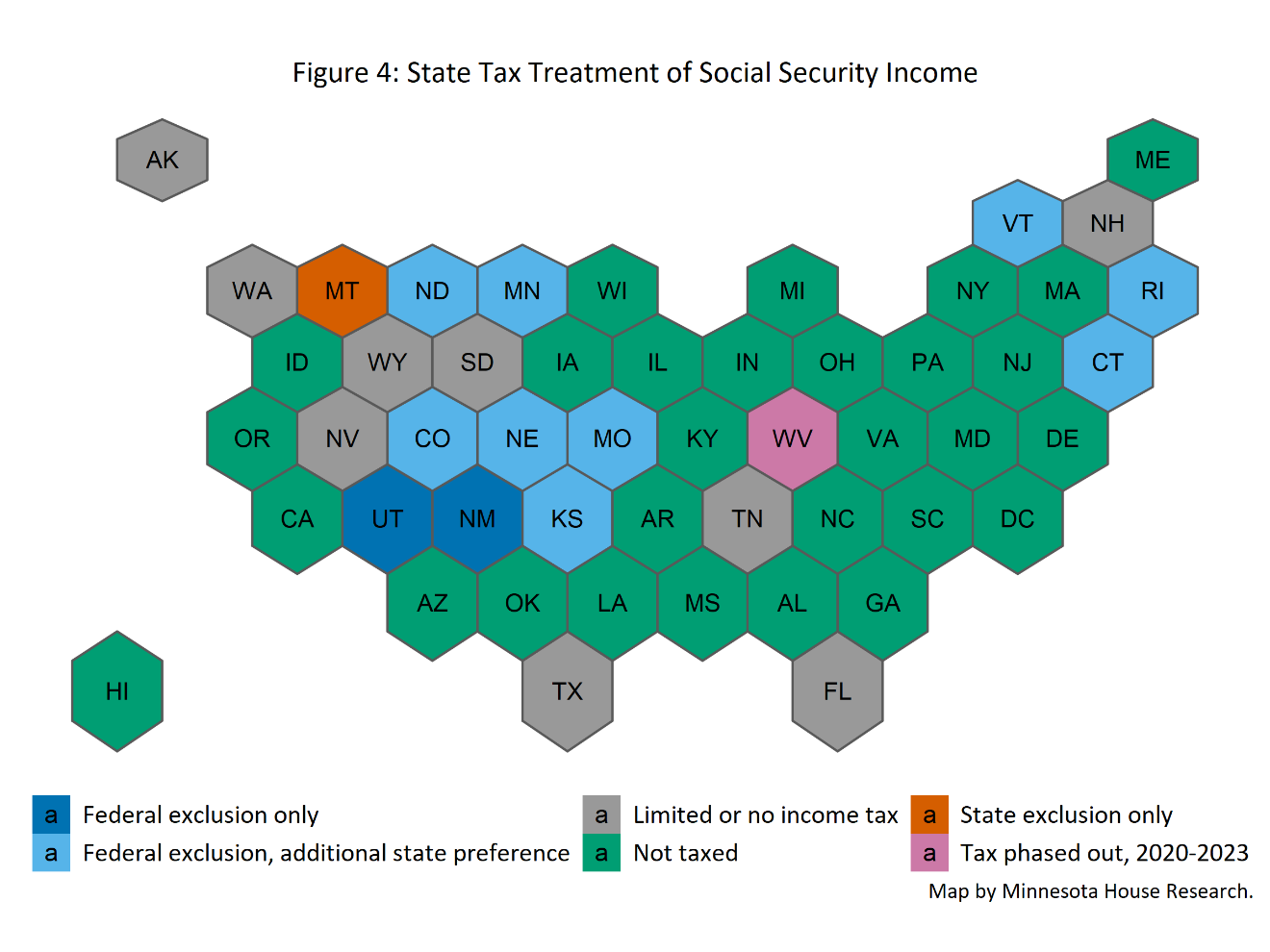

What are the 3 states that don’t tax retirement income?

Nine of those states that do not tax retirement plan income just because retirement plan payouts are considered income, and these nine states have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee , Texas, Washington, and Wyoming.

Which 26 states that do not collect ZUS? Alaska, Florida, Illinois, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Which states do not tax pensions?

But again, there are many states (14 to be exact) that don’t tax your retirement income at all. They are: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Washington, Wyoming New Hampshire, Alabama, Illinois, Hawaii, Mississippi, and Pennsylvania.

How can I avoid paying tax on my pension?

Most pension plans employers are required to withhold the mandatory 20% lump sum payment when they leave the company. However, you can avoid this tax hit if you roll these funds directly into a rollover IRA or other similar qualified plan.

Do all states tax your pension?

Eight states – Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming – tax no income at all. The ninth state, New Hampshire, taxes only capital gains and dividend income. And five states – Alabama, Illinois, Hawaii, Mississippi, and Pennsylvania – exclude retirement income from state taxes.

What is the most tax friendly state for retirees?

1. Delaware. Congratulations Delaware – you are the most tax-friendly state for retirees! With no sales tax, low property taxes, and no death tax, it’s easy to see why Delaware is a tax haven for retirees.

Sources :