How long does a pending withdrawal take?

The bank knows this, but the funds have not yet moved. In the meantime, a withdrawal withdraws funds from your account immediately. All in all, the words pending withdrawal mean that the funds will be withdrawn from your account soon, perhaps within one to three business days.

How long does a withdrawal request take? The timing of a withdrawal depends on several factors, such as the time of day the withdrawal request is made and the institution receiving your funds, but most withdrawals take 3 to 4 business days before the requested funds return to your bank account.

Why are pending withdrawals negative?

A negative float is a net deficit resulting from checks that have been deposited but have not settled bank records. Traditionally, a check writer keeps a record in order to balance the account and avoid being confused by an account balance that can show funds pending withdrawal to cover written checks.

What does a negative pending transaction mean?

If the available balance (current balance less outstanding transactions) is negative, a fee may be charged and the item may or may not be paid, depending on your overdraft protection settings, account history, and privilege settings. overdose. …

Is pending transactions already deducted from balance?

The transaction amount will be deducted from your available funds only when the transaction is pending. It only changes when the payment has been fully processed, so your account balance is not affected by the pending transaction, and these will be deducted from your account.

Does pending transaction mean they took the money out?

What is a pending transaction? Pending means that a transaction has been sent to withdraw money or add money to your account, but it has not been completed.

Can you withdraw money while pending?

Can a pending direct deposit be withdrawn? A pending direct deposit cannot be withdrawn, as your bank is still in the process of verification. Once the deposit is authorized, you will be able to use these funds, including to withdraw them.

How long does it take for pending funds to clear?

What is a pending transaction and how long can it remain pending? A pending transaction is a recent card transaction that the merchant has not yet fully processed. If the merchant does not withdraw funds from your account, in most cases they will be re-incorporated into the account within 7 days.

Can I spend my pending balance?

No, when there is a pending deposit, you cannot use any of the money. Because all deposits must be verified and authorized before they are available for use, you must wait until a pending deposit is added to your “available balance” before you can access them.

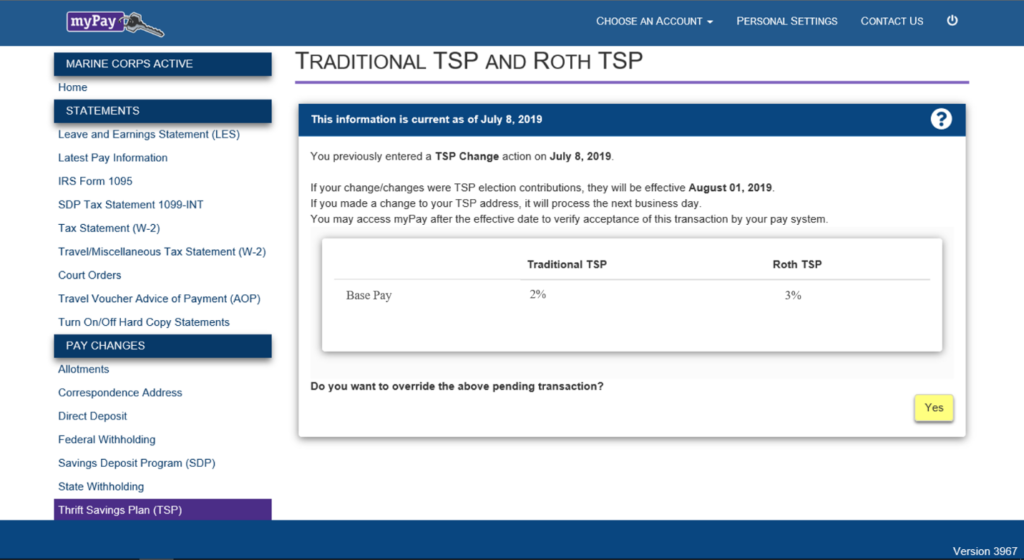

Can I still contribute to my TSP after separation?

Once you separate, you will no longer be able to make employee contributions. However, you can transfer money to your TSP account from IRAs (though not Roth IRAs) and from eligible business plans.

What happens to TSP when you divorce? A court order will freeze your TSP account, which means no withdrawals or loans can be made until the divorce is complete. Unless excluded from the court order, any outstanding balance of the loan will be included in the account balance when calculating your ex-spouse’s premium.

Can you continue to put money in TSP after separation?

When you separate, you can leave your full account balance in the TSP if it’s $ 200 or more. Your account will continue to accrue income, and you can continue to change the way your money is invested in TSP’s five mutual funds by making transfers between funds. You can make a transfer between funds at any time.

Can I keep my TSP if I quit?

You can keep your TSP after you leave federal service If you decide to keep your TSP account, you can continue to change how your money is invested in TSP funds by making transfers between funds. Once you close your TSP after leaving federal service, you will not be able to open another account in the future.

What should I do with my TSP when I separate?

Leaving the federal government

- Make sure your TSP has your current address at all times.

- If you have TSP loans, pay them off within 90 days of your separation.

- Read Withdrawal from your TSP account for separate participants and beneficiaries to fully understand your options.

How much will I lose if I withdraw my TSP?

The Internal Revenue Service charges a 10 percent tax penalty for early withdrawal on these TSP withdrawals, as it does with early withdrawals from other qualified tax deferred retirement accounts. If you withdraw money due to financial difficulty, you cannot make additional contributions to the TSP for six months.

What happens if I retire from my TSP? The early withdrawal penalty is a 10% penalty. In addition to the taxes you owe on your withdrawal, you will have to pay 10%. The possibility of avoiding the early retirement penalty if you separate in the year you turn 50 or 55 only applies if you leave your money in the TSP; changes are subject to sanction.

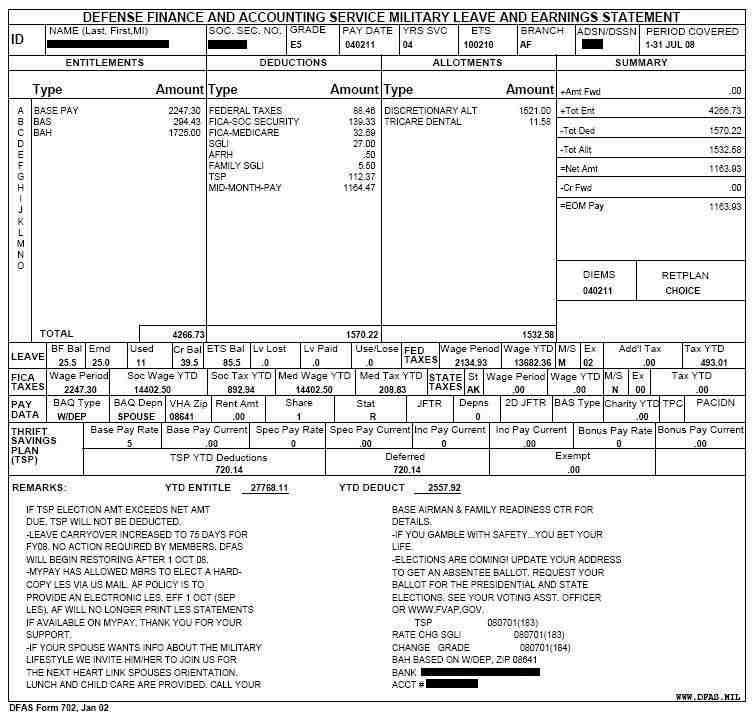

Does TSP withdrawal count as income?

The general rules on federal income tax withdrawals from the savings savings plan are: A) All withdrawals from your traditional TSP balance are fully subject to taxes as ordinary income; B) All qualified withdrawals from your Roth TSP balance are exempt from federal income tax; and C) In any unqualified …

Does TSP withdrawal affect Social Security?

Most federal employees and their spouses will face Social Security taxes. … Indeed, the withdrawal of the TSP causes two taxes: the TSP dollar tax and a Social Security tax that you would not have had to pay otherwise.

Is TSP withdrawal considered earned income?

TSP withdrawals are not considered revenue earned.

Is TSP considered income?

Money that is in the traditional balance of your TSP account is fully taxable as ordinary income when it is withdrawn. This means that you do not receive favorable tax treatment such as you would receive a long-term capital gain or a qualified dividend.

How much is TSP taxed when withdrawn?

â € œBecause the TSP is making a payment directly to the TSP participant and not to another qualified retirement plan or IRA, the TSP must withhold 20 percent of federal income taxes.

What happens if I withdraw from my TSP?

â € œThere will be no income tax penalties if you repay within that period. … “The downside of withdrawing from your TSP is that the money withdrawn is no longer an investment and has now become a debt to be paid or taxed,” Schmidt said.

Do TSP withdrawals count as income?

A. TSP withdrawals are not considered revenue earned.

How much will I be taxed if I withdraw my TSP?

It’s also important to keep in mind that the TSP has to withhold 20% of traditional TSP distributions to cover taxes, so you may have to take out more than initially thought. This does not mean that you will owe exactly 20% of your tax distribution. It could be more or less than that.

When am I fully vested in my TSP?

When you are eligible, your agency automatically deposits an amount equal to 1% of your base pay into your TSP account each payment period, even if you do not contribute your own money. After 3 years of federal civil service (or 2 years in some cases), you have these contributions and your income.

How many years does it take to spend in the federal government? To be acquired (eligible to receive your basic benefit plan retirement benefits if you leave federal service before you retire), you must have at least 5 years of credible civil service. Survivor and disability benefits are available after 18 months of civil service.

What is the average amount in TSP balance at retirement?

| Age | Average contribution rate | Average balance |

|---|---|---|

| 60-69 | 11% | $ 182,100 |

| 70-79 | 12% | $ 171,400 |

| All ages | 9% | $ 95,600 |

Who manages the Thrift Savings Plan?

The five core funds offered in the Thrift Savings Plan freely cover the basic range of debt securities and listed shares. All five funds are managed by Blackrock Capital Advisers and are only available to TSP participants.

How much should I have in my TSP when I retire?

How Much Should You Invest in a TSP Account? We recommend that you invest 15% of your retirement income. When you contribute 15% consistently, you prepare to have options when you retire.

What is USPS Thrift Savings Plan?

The savings savings plan (TSP), which Congress authorized in the Federal Employee Retirement System Act of 1986, is a retirement savings and investment plan for federal employees. The Federal Retirement Thrift Investment Board (FRTIB), an independent government agency, administers the plan.

How long do you have to work for the federal government to get a pension?

You must work with the federal government for at least 5 years before you are eligible for a FERS federal pension, and for each year you work, you will be able to earn at least 1% of your average high salary history. 3. Automatic deductions that can go from .

What is the average pension of a federal employee?

The defined benefits of the FERS are smaller: an average of about $ 1,600 per month and an average of about $ 1,300, for annual figures of $ 19,200 and $ 15,600, because this program also includes Social Security as a basic element.

Do you get a pension working for the federal government?

The Federal Employee Retirement System, or FERS, is the retirement plan for all civilian employees in the United States. FERS employees receive retirement benefits from three sources: the basic benefit plan, Social Security, and the savings plan (TSP).

Can I get pension after 5 years?

This usually means that if you quit your job in five years or less, you lose all of your pension benefits. But if you leave after five years, you will receive 100% of the promised benefits. Graduated acquisition. With this type of acquisition, you are entitled to at least 20% of your benefit if you leave after three years.