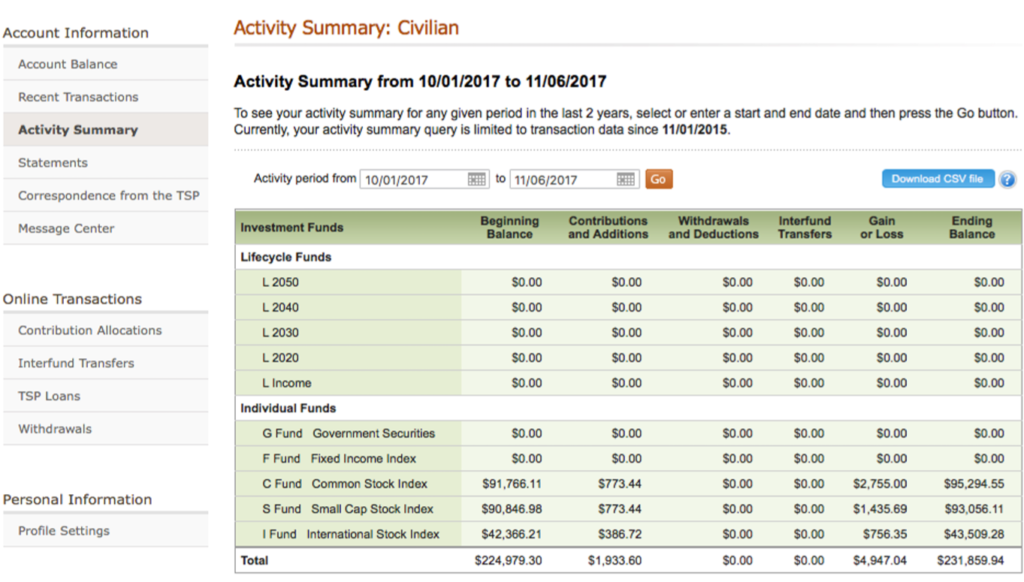

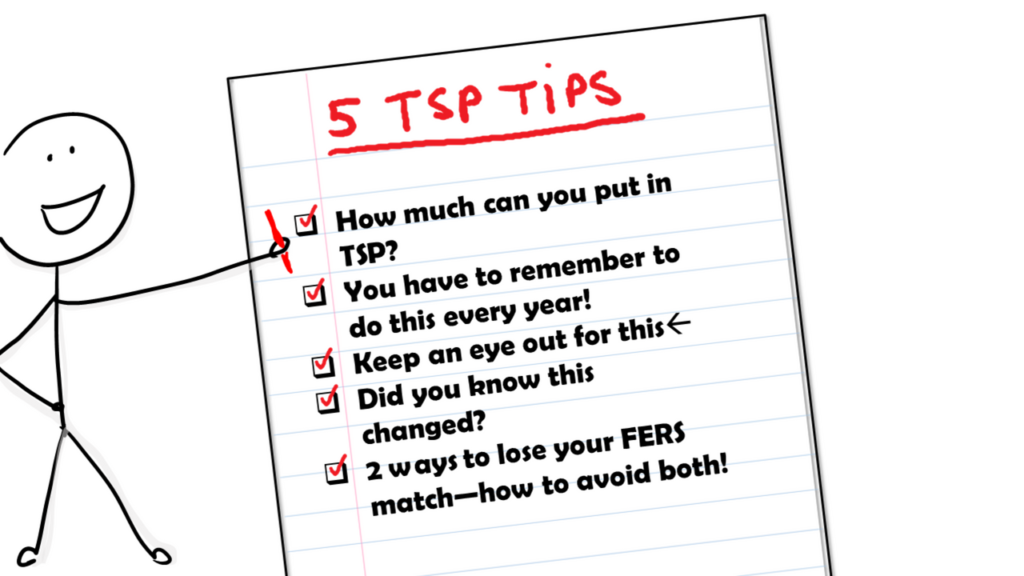

Should I max out TSP?

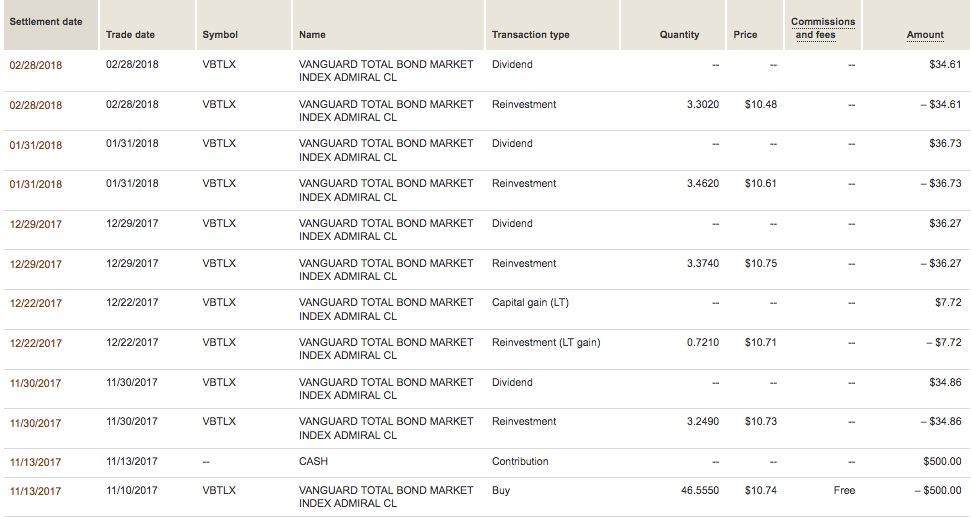

How much are you taxed when you withdraw your TSP? We will retain 10% on the taxable portion of your federal income tax withdrawal. You have the option to increase or decrease this retention. The taxable portion of your withdrawal is subject to federal income tax at your usual rate. How much are you taxed …